Page 220 - EXIM_AR2021

P. 220

218 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

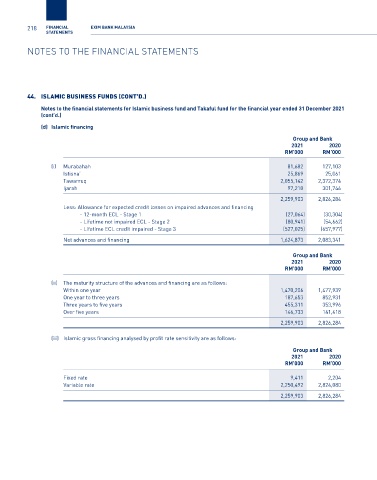

44. islamic bUsiness fUnDs (cOnt’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2021

(cont’d.)

(d) Islamic financing

Group and Bank

2021 2020

RM’000 RM’000

(i) Murabahah 81,682 127,103

Istisna’ 25,869 25,061

Tawarruq 2,055,142 2,372,374

Ijarah 97,210 301,746

2,259,903 2,826,284

Less: Allowance for expected credit losses on impaired advances and financing

- 12-month ECL - Stage 1 (27,064) (30,304)

- Lifetime not impaired ECL - Stage 2 (80,941) (54,662)

- Lifetime ECL credit impaired - Stage 3 (527,025) (657,977)

Net advances and financing 1,624,873 2,083,341

Group and Bank

2021 2020

RM’000 RM’000

(ii) The maturity structure of the advances and financing are as follows:

Within one year 1,470,206 1,477,939

One year to three years 187,653 852,931

Three years to five years 455,311 353,996

Over five years 146,733 141,418

2,259,903 2,826,284

(iii) Islamic gross financing analysed by profit rate sensitivity are as follows:

Group and Bank

2021 2020

RM’000 RM’000

Fixed rate 9,411 2,204

Variable rate 2,250,492 2,824,080

2,259,903 2,826,284