Page 110 - EXIM_ IAR24_EBook

P. 110

EXIM BANK MALAYSIA

108

INDEPENDENT AUDITORS’ REPORT

TO THE MEMBERS OF EXPORT-IMPORT BANK OF MALAYSIA BERHAD

(INCORPORATED IN MALAYSIA)

Key audit matters (cont’d)

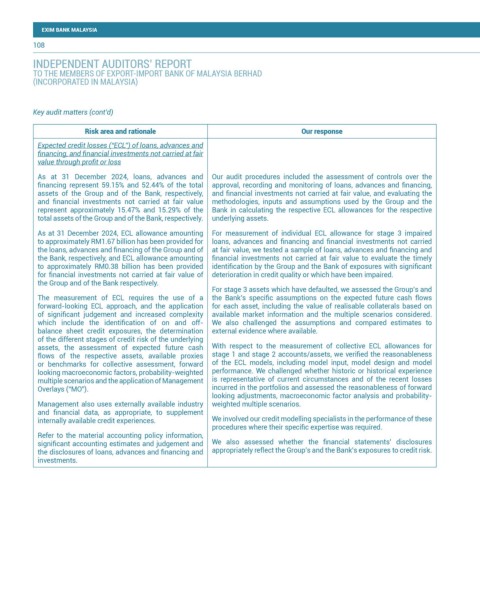

Risk area and rationale Our response

Expected credit losses (“ECL”) of loans, advances and

financing, and financial investments not carried at fair

value through profit or loss

As at 31 December 2024, loans, advances and Our audit procedures included the assessment of controls over the

financing represent 59.15% and 52.44% of the total approval, recording and monitoring of loans, advances and financing,

assets of the Group and of the Bank, respectively, and financial investments not carried at fair value, and evaluating the

and financial investments not carried at fair value methodologies, inputs and assumptions used by the Group and the

represent approximately 15.47% and 15.29% of the Bank in calculating the respective ECL allowances for the respective

total assets of the Group and of the Bank, respectively. underlying assets.

As at 31 December 2024, ECL allowance amounting For measurement of individual ECL allowance for stage 3 impaired

to approximately RM1.67 billion has been provided for loans, advances and financing and financial investments not carried

the loans, advances and financing of the Group and of at fair value, we tested a sample of loans, advances and financing and

the Bank, respectively, and ECL allowance amounting financial investments not carried at fair value to evaluate the timely

to approximately RM0.38 billion has been provided identification by the Group and the Bank of exposures with significant

for financial investments not carried at fair value of deterioration in credit quality or which have been impaired.

the Group and of the Bank respectively.

For stage 3 assets which have defaulted, we assessed the Group’s and

The measurement of ECL requires the use of a the Bank’s specific assumptions on the expected future cash flows

forward-looking ECL approach, and the application for each asset, including the value of realisable collaterals based on

of significant judgement and increased complexity available market information and the multiple scenarios considered.

which include the identification of on and off- We also challenged the assumptions and compared estimates to

balance sheet credit exposures, the determination external evidence where available.

of the different stages of credit risk of the underlying

assets, the assessment of expected future cash With respect to the measurement of collective ECL allowances for

flows of the respective assets, available proxies stage 1 and stage 2 accounts/assets, we verified the reasonableness

or benchmarks for collective assessment, forward of the ECL models, including model input, model design and model

looking macroeconomic factors, probability-weighted performance. We challenged whether historic or historical experience

multiple scenarios and the application of Management is representative of current circumstances and of the recent losses

Overlays (“MO”). incurred in the portfolios and assessed the reasonableness of forward

looking adjustments, macroeconomic factor analysis and probability-

Management also uses externally available industry weighted multiple scenarios.

and financial data, as appropriate, to supplement

internally available credit experiences. We involved our credit modelling specialists in the performance of these

procedures where their specific expertise was required.

Refer to the material accounting policy information,

significant accounting estimates and judgement and We also assessed whether the financial statements’ disclosures

the disclosures of loans, advances and financing and appropriately reflect the Group’s and the Bank’s exposures to credit risk.

investments.