Page 118 - EXIM_ IAR24_EBook

P. 118

EXIM BANK MALAYSIA

116

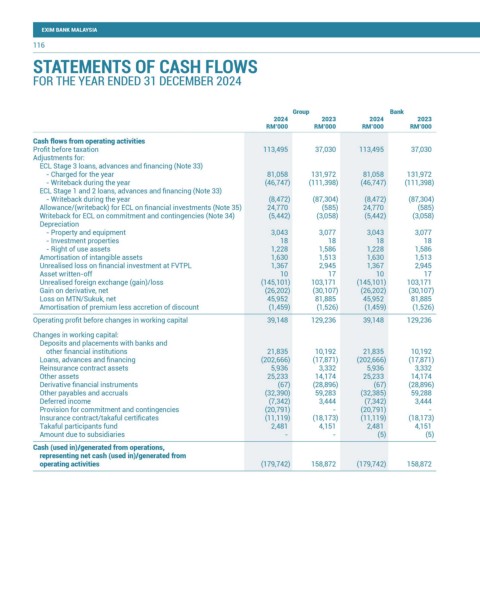

STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2024

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Cash flows from operating activities

Profit before taxation 113,495 37,030 113,495 37,030

Adjustments for:

ECL Stage 3 loans, advances and financing (Note 33)

- Charged for the year 81,058 131,972 81,058 131,972

- Writeback during the year (46,747) (111,398) (46,747) (111,398)

ECL Stage 1 and 2 loans, advances and financing (Note 33)

- Writeback during the year (8,472) (87,304) (8,472) (87,304)

Allowance/(writeback) for ECL on financial investments (Note 35) 24,770 (585) 24,770 (585)

Writeback for ECL on commitment and contingencies (Note 34) (5,442) (3,058) (5,442) (3,058)

Depreciation

- Property and equipment 3,043 3,077 3,043 3,077

- Investment properties 18 18 18 18

- Right of use assets 1,228 1,586 1,228 1,586

Amortisation of intangible assets 1,630 1,513 1,630 1,513

Unrealised loss on financial investment at FVTPL 1,367 2,945 1,367 2,945

Asset written-off 10 17 10 17

Unrealised foreign exchange (gain)/loss (145,101) 103,171 (145,101) 103,171

Gain on derivative, net (26,202) (30,107) (26,202) (30,107)

Loss on MTN/Sukuk, net 45,952 81,885 45,952 81,885

Amortisation of premium less accretion of discount (1,459) (1,526) (1,459) (1,526)

Operating profit before changes in working capital 39,148 129,236 39,148 129,236

Changes in working capital:

Deposits and placements with banks and

other financial institutions 21,835 10,192 21,835 10,192

Loans, advances and financing (202,666) (17,871) (202,666) (17,871)

Reinsurance contract assets 5,936 3,332 5,936 3,332

Other assets 25,233 14,174 25,233 14,174

Derivative financial instruments (67) (28,896) (67) (28,896)

Other payables and accruals (32,390) 59,283 (32,385) 59,288

Deferred income (7,342) 3,444 (7,342) 3,444

Provision for commitment and contingencies (20,791) - (20,791) -

Insurance contract/takaful certificates (11,119) (18,173) (11,119) (18,173)

Takaful participants fund 2,481 4,151 2,481 4,151

Amount due to subsidiaries - - (5) (5)

Cash (used in)/generated from operations,

representing net cash (used in)/generated from

operating activities (179,742) 158,872 (179,742) 158,872