Page 116 - EXIM-Bank_Annual-Report-2023

P. 116

EXIM BANK MALAYSIA

114 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

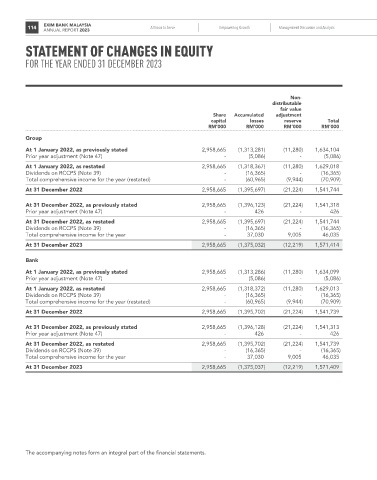

STaTEmEnT Of ChangES In EquITy

for the year ended 31 december 2023

Non-

distributable

fair value

Share Accumulated adjustment

capital losses reserve Total

rM’000 rM’000 rM’000 rM’000

Group

At 1 January 2022, as previously stated 2,958,665 (1,313,281) (11,280) 1,634,104

Prior year adjustment (Note 47) - (5,086) - (5,086)

At 1 January 2022, as restated 2,958,665 (1,318,367) (11,280) 1,629,018

Dividends on RCCPS (Note 39) - (16,365) - (16,365)

Total comprehensive income for the year (restated) - (60,965) (9,944) (70,909)

At 31 December 2022 2,958,665 (1,395,697) (21,224) 1,541,744

At 31 December 2022, as previously stated 2,958,665 (1,396,123) (21,224) 1,541,318

Prior year adjustment (Note 47) - 426 - 426

At 31 December 2022, as restated 2,958,665 (1,395,697) (21,224) 1,541,744

Dividends on RCCPS (Note 39) - (16,365) - (16,365)

Total comprehensive income for the year - 37,030 9,005 46,035

At 31 December 2023 2,958,665 (1,375,032) (12,219) 1,571,414

Bank

At 1 January 2022, as previously stated 2,958,665 (1,313,286) (11,280) 1,634,099

Prior year adjustment (Note 47) - (5,086) - (5,086)

At 1 January 2022, as restated 2,958,665 (1,318,372) (11,280) 1,629,013

Dividends on RCCPS (Note 39) - (16,365) - (16,365)

Total comprehensive income for the year (restated) - (60,965) (9,944) (70,909)

At 31 December 2022 2,958,665 (1,395,702) (21,224) 1,541,739

At 31 December 2022, as previously stated 2,958,665 (1,396,128) (21,224) 1,541,313

Prior year adjustment (Note 47) - 426 - 426

At 31 December 2022, as restated 2,958,665 (1,395,702) (21,224) 1,541,739

Dividends on RCCPS (Note 39) - (16,365) - (16,365)

Total comprehensive income for the year - 37,030 9,005 46,035

At 31 December 2023 2,958,665 (1,375,037) (12,219) 1,571,409

The accompanying notes form an integral part of the financial statements.