Page 117 - EXIM-Bank_Annual-Report-2023

P. 117

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 115

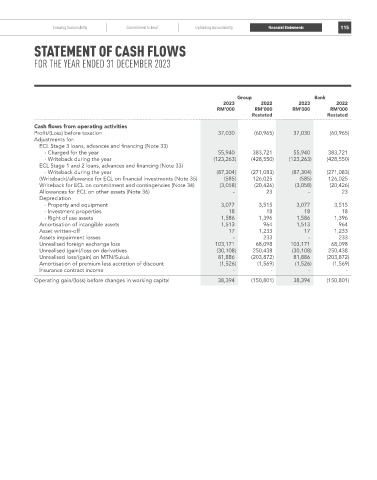

STaTEmEnT Of CaSh flOwS

for the year ended 31 december 2023

Group Bank

2023 2022 2023 2022

rM’000 rM’000 rM’000 rM’000

restated restated

Cash flows from operating activities

Profit/(Loss) before taxation 37,030 (60,965) 37,030 (60,965)

Adjustments for:

ECL Stage 3 loans, advances and financing (Note 33)

- Charged for the year 55,940 383,721 55,940 383,721

- Writeback during the year (123,263) (428,550) (123,263) (428,550)

ECL Stage 1 and 2 loans, advances and financing (Note 33)

- Writeback during the year (87,304) (271,083) (87,304) (271,083)

(Writeback)/allowance for ECL on financial investments (Note 35) (585) 126,025 (585) 126,025

Writeback for ECL on commitment and contingencies (Note 34) (3,058) (20,426) (3,058) (20,426)

Allowances for ECL on other assets (Note 36) - 23 - 23

Depreciation

- Property and equipment 3,077 3,515 3,077 3,515

- Investment properties 18 18 18 18

- Right of use assets 1,586 1,396 1,586 1,396

Amortisation of intangible assets 1,513 964 1,513 964

Asset written-off 17 1,233 17 1,233

Assets impairment losses - 233 - 233

Unrealised foreign exchange loss 103,171 68,098 103,171 68,098

Unrealised (gain)/loss on derivatives (30,108) 250,438 (30,108) 250,438

Unrealised loss/(gain) on MTN/Sukuk 81,886 (203,872) 81,886 (203,872)

Amortisation of premium less accretion of discount (1,526) (1,569) (1,526) (1,569)

Insurance contract income - - - -

Operating gain/(loss) before changes in working capital 38,394 (150,801) 38,394 (150,801)