Page 246 - EXIM_ IAR24_EBook

P. 246

EXIM BANK MALAYSIA

244

NOTES TO THE FINANCIAL STATEMENTS

46. SIGNIFICANT EVENTS

In the Budget 2024 speech delivered on 13 October 2023, the Prime Minister announced the plan to restructure

Development Financial Institutions (“DFI’s”) in Malaysia. The restructuring involves merging Bank Pembangunan Malaysia

Berhad (“BPMB”), Export-Import Bank of Malaysia Berhad (“EXIM”) and SME Bank Berhad (“SMEB”).

This initiative aims to enhance the efficiency and synergy of these institutions and strengthen the development

finance ecosystem. The corporate exercise, currently underway, is intended to better support the nation’s economic and

development goals.

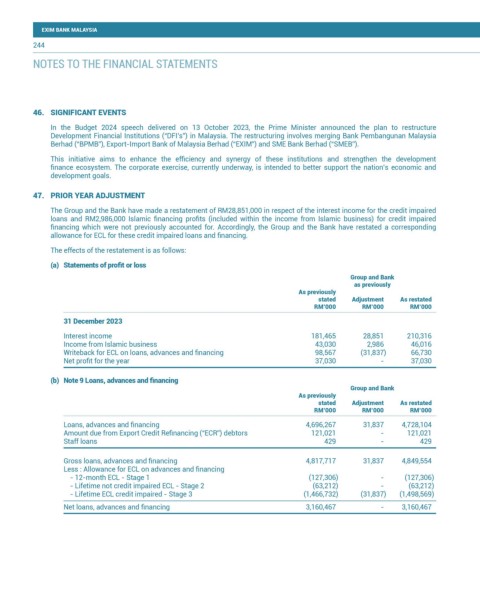

47. PRIOR YEAR ADJUSTMENT

The Group and the Bank have made a restatement of RM28,851,000 in respect of the interest income for the credit impaired

loans and RM2,986,000 Islamic financing profits (included within the income from Islamic business) for credit impaired

financing which were not previously accounted for. Accordingly, the Group and the Bank have restated a corresponding

allowance for ECL for these credit impaired loans and financing.

The effects of the restatement is as follows:

(a) Statements of profit or loss

Group and Bank

as previously

As previously

stated Adjustment As restated

RM’000 RM’000 RM’000

31 December 2023

Interest income 181,465 28,851 210,316

Income from Islamic business 43,030 2,986 46,016

Writeback for ECL on loans, advances and financing 98,567 (31,837) 66,730

Net profit for the year 37,030 - 37,030

(b) Note 9 Loans, advances and financing

Group and Bank

As previously

stated Adjustment As restated

RM’000 RM’000 RM’000

Loans, advances and financing 4,696,267 31,837 4,728,104

Amount due from Export Credit Refinancing (“ECR”) debtors 121,021 - 121,021

Staff loans 429 - 429

Gross loans, advances and financing 4,817,717 31,837 4,849,554

Less : Allowance for ECL on advances and financing

- 12-month ECL - Stage 1 (127,306) - (127,306)

- Lifetime not credit impaired ECL - Stage 2 (63,212) - (63,212)

- Lifetime ECL credit impaired - Stage 3 (1,466,732) (31,837) (1,498,569)

Net loans, advances and financing 3,160,467 - 3,160,467