Page 241 - EXIM_ IAR24_EBook

P. 241

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 239

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

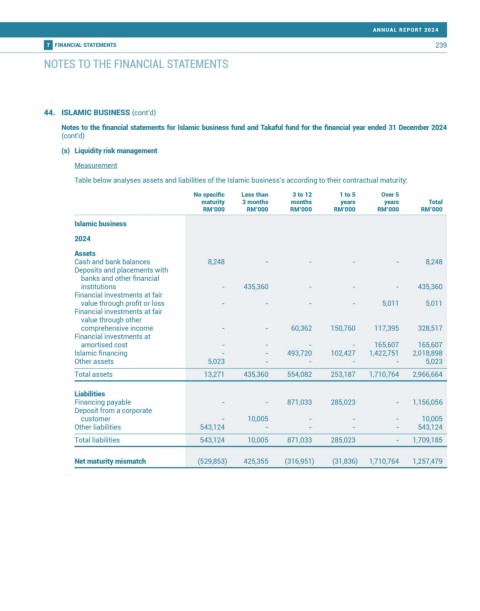

(s) Liquidity risk management

Measurement

Table below analyses assets and liabilities of the Islamic business’s according to their contractual maturity:

No specific Less than 3 to 12 1 to 5 Over 5

maturity 3 months months years years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Islamic business

2024

Assets

Cash and bank balances 8,248 - - - - 8,248

Deposits and placements with

banks and other financial

institutions - 435,360 - - - 435,360

Financial investments at fair

value through profit or loss - - - - 5,011 5,011

Financial investments at fair

value through other

comprehensive income - - 60,362 150,760 117,395 328,517

Financial investments at

amortised cost - - - - 165,607 165,607

Islamic financing - - 493,720 102,427 1,422,751 2,018,898

Other assets 5,023 - - - - 5,023

Total assets 13,271 435,360 554,082 253,187 1,710,764 2,966,664

Liabilities

Financing payable - - 871,033 285,023 - 1,156,056

Deposit from a corporate

customer - 10,005 - - - 10,005

Other liabilities 543,124 - - - - 543,124

Total liabilities 543,124 10,005 871,033 285,023 - 1,709,185

Net maturity mismatch (529,853) 425,355 (316,951) (31,836) 1,710,764 1,257,479