Page 237 - EXIM_ IAR24_EBook

P. 237

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 235

NOTES TO THE FINANCIAL STATEMENTS

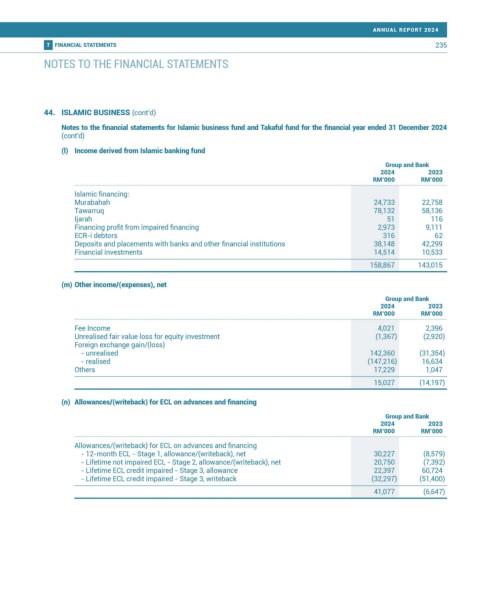

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

(l) Income derived from Islamic banking fund

Group and Bank

2024 2023

RM’000 RM’000

Islamic financing:

Murabahah 24,733 22,758

Tawarruq 78,132 58,136

Ijarah 51 116

Financing profit from impaired financing 2,973 9,111

ECR-i debtors 316 62

Deposits and placements with banks and other financial institutions 38,148 42,299

Financial investments 14,514 10,533

158,867 143,015

(m) Other income/(expenses), net

Group and Bank

2024 2023

RM’000 RM’000

Fee Income 4,021 2,396

Unrealised fair value loss for equity investment (1,367) (2,920)

Foreign exchange gain/(loss)

- unrealised 142,360 (31,354)

- realised (147,216) 16,634

Others 17,229 1,047

15,027 (14,197)

(n) Allowances/(writeback) for ECL on advances and financing

Group and Bank

2024 2023

RM’000 RM’000

Allowances/(writeback) for ECL on advances and financing

- 12-month ECL - Stage 1, allowance/(writeback), net 30,227 (8,579)

- Lifetime not impaired ECL - Stage 2, allowance/(writeback), net 20,750 (7,392)

- Lifetime ECL credit impaired - Stage 3, allowance 22,397 60,724

- Lifetime ECL credit impaired - Stage 3, writeback (32,297) (51,400)

41,077 (6,647)