Page 239 - EXIM_ IAR24_EBook

P. 239

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 237

NOTES TO THE FINANCIAL STATEMENTS

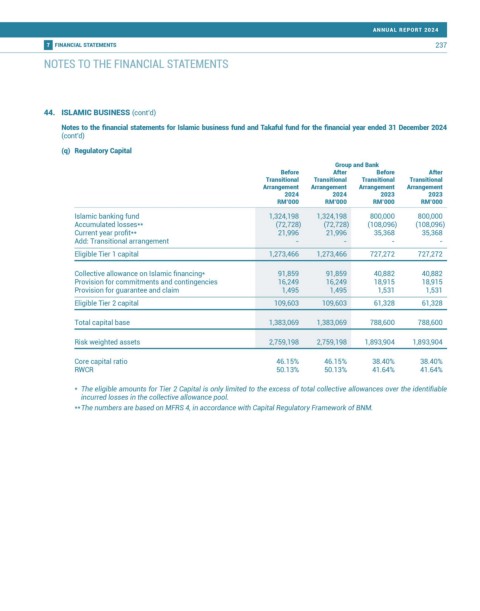

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

(q) Regulatory Capital

Group and Bank

Before After Before After

Transitional Transitional Transitional Transitional

Arrangement Arrangement Arrangement Arrangement

2024 2024 2023 2023

RM’000 RM’000 RM’000 RM’000

Islamic banking fund 1,324,198 1,324,198 800,000 800,000

Accumulated losses** (72,728) (72,728) (108,096) (108,096)

Current year profit** 21,996 21,996 35,368 35,368

Add: Transitional arrangement - - - -

Eligible Tier 1 capital 1,273,466 1,273,466 727,272 727,272

Collective allowance on Islamic financing* 91,859 91,859 40,882 40,882

Provision for commitments and contingencies 16,249 16,249 18,915 18,915

Provision for guarantee and claim 1,495 1,495 1,531 1,531

Eligible Tier 2 capital 109,603 109,603 61,328 61,328

Total capital base 1,383,069 1,383,069 788,600 788,600

Risk weighted assets 2,759,198 2,759,198 1,893,904 1,893,904

Core capital ratio 46.15% 46.15% 38.40% 38.40%

RWCR 50.13% 50.13% 41.64% 41.64%

* The eligible amounts for Tier 2 Capital is only limited to the excess of total collective allowances over the identifiable

incurred losses in the collective allowance pool.

** The numbers are based on MFRS 4, in accordance with Capital Regulatory Framework of BNM.