Page 235 - EXIM_ IAR24_EBook

P. 235

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 233

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

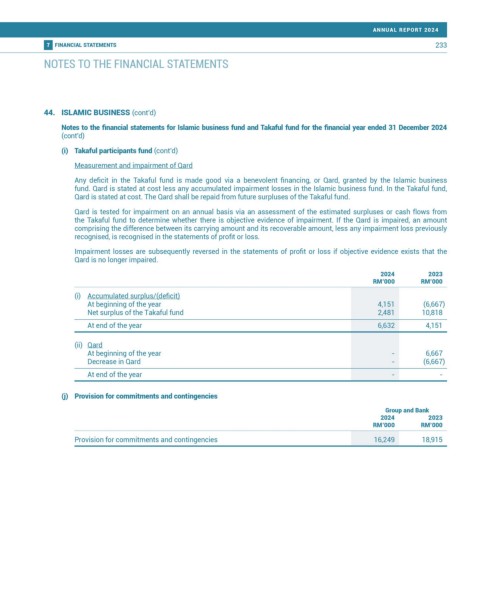

(i) Takaful participants fund (cont’d)

Measurement and impairment of Qard

Any deficit in the Takaful fund is made good via a benevolent financing, or Qard, granted by the Islamic business

fund. Qard is stated at cost less any accumulated impairment losses in the Islamic business fund. In the Takaful fund,

Qard is stated at cost. The Qard shall be repaid from future surpluses of the Takaful fund.

Qard is tested for impairment on an annual basis via an assessment of the estimated surpluses or cash flows from

the Takaful fund to determine whether there is objective evidence of impairment. If the Qard is impaired, an amount

comprising the difference between its carrying amount and its recoverable amount, less any impairment loss previously

recognised, is recognised in the statements of profit or loss.

Impairment losses are subsequently reversed in the statements of profit or loss if objective evidence exists that the

Qard is no longer impaired.

2024 2023

RM’000 RM’000

(i) Accumulated surplus/(deficit)

At beginning of the year 4,151 (6,667)

Net surplus of the Takaful fund 2,481 10,818

At end of the year 6,632 4,151

(ii) Qard

At beginning of the year - 6,667

Decrease in Qard - (6,667)

At end of the year - -

(j) Provision for commitments and contingencies

Group and Bank

2024 2023

RM’000 RM’000

Provision for commitments and contingencies 16,249 18,915