Page 234 - EXIM_ IAR24_EBook

P. 234

EXIM BANK MALAYSIA

232

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

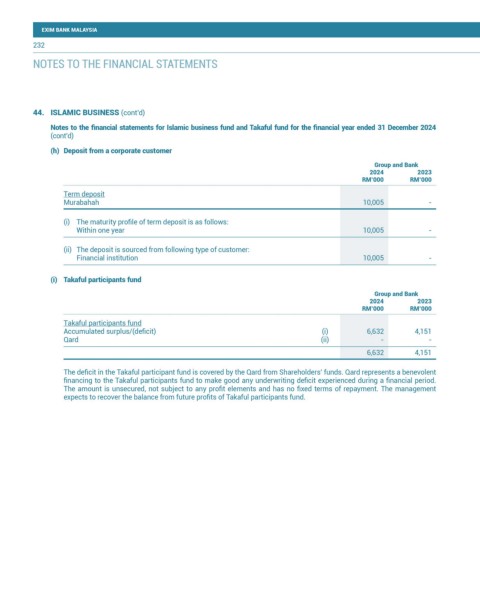

(h) Deposit from a corporate customer

Group and Bank

2024 2023

RM’000 RM’000

Term deposit

Murabahah 10,005 -

(i) The maturity profile of term deposit is as follows:

Within one year 10,005 -

(ii) The deposit is sourced from following type of customer:

Financial institution 10,005 -

(i) Takaful participants fund

Group and Bank

2024 2023

RM’000 RM’000

Takaful participants fund

Accumulated surplus/(deficit) (i) 6,632 4,151

Qard (ii) - -

6,632 4,151

The deficit in the Takaful participant fund is covered by the Qard from Shareholders’ funds. Qard represents a benevolent

financing to the Takaful participants fund to make good any underwriting deficit experienced during a financial period.

The amount is unsecured, not subject to any profit elements and has no fixed terms of repayment. The management

expects to recover the balance from future profits of Takaful participants fund.