Page 205 - EXIM_ IAR24_EBook

P. 205

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 203

NOTES TO THE FINANCIAL STATEMENTS

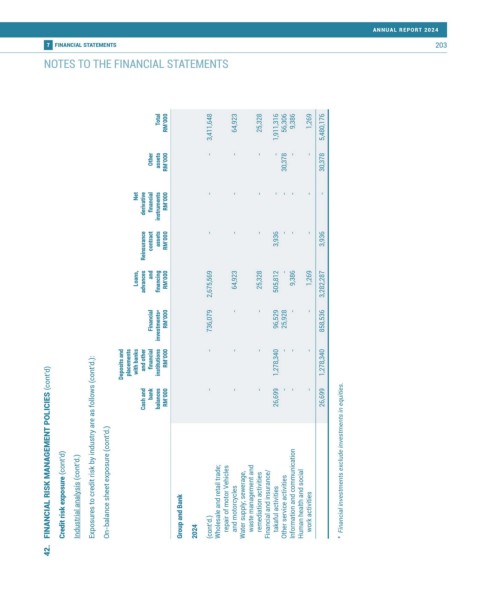

Total RM’000 3,411,648 64,923 25,328 1,911,316 56,306 9,386 1,269 5,480,176

Other assets RM’000 - - - - 30,378 - - 30,378

derivative financial instruments RM’000

Net - - - - - - - -

Reinsurance contract assets RM’000 - - - 3,936 - - - 3,936

-

Loans, advances and financing RM’000 2,675,569 64,923 25,328 505,812 9,386 1,269 3,282,287

- - - -

Financial investments* RM’000 736,079 96,529 25,928 858,536

Deposits and placements with banks and other financial institutions RM’000 - - - 1,278,340 - - - 1,278,340

FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

bank - - - - - -

Cash and balances RM’000 26,699 26,699

Credit risk exposure (cont’d) Industrial analysis (cont’d.) Exposures to credit risk by industry are as follows (cont’d.): On-balance sheet exposure (cont’d.) Group and Bank Wholesale and retail trade; repair of motor Vehicles and motorcycles Water supply; sewerage, waste management and remediation activities Financial and insurance/ takaful activities Other service activities Information and communication Human health and social work activities

42. 2024 (cont’d.)