Page 210 - EXIM_ IAR24_EBook

P. 210

EXIM BANK MALAYSIA

208

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Credit quality by class of financial assets (cont’d)

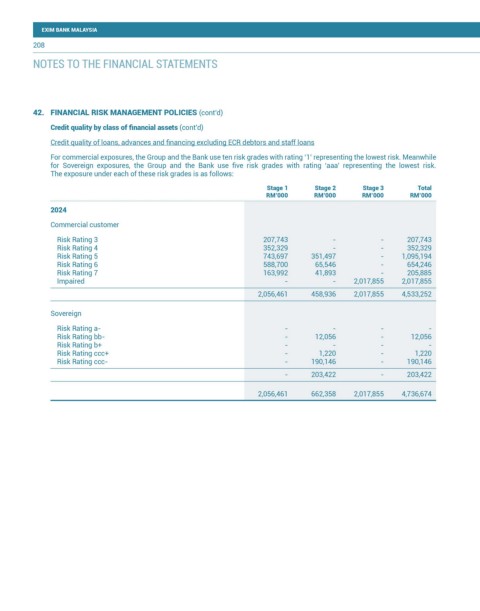

Credit quality of loans, advances and financing excluding ECR debtors and staff loans

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk.

The exposure under each of these risk grades is as follows:

Stage 1 Stage 2 Stage 3 Total

RM’000 RM’000 RM’000 RM’000

2024

Commercial customer

Risk Rating 3 207,743 - - 207,743

Risk Rating 4 352,329 - - 352,329

Risk Rating 5 743,697 351,497 - 1,095,194

Risk Rating 6 588,700 65,546 - 654,246

Risk Rating 7 163,992 41,893 - 205,885

Impaired - - 2,017,855 2,017,855

2,056,461 458,936 2,017,855 4,533,252

Sovereign

Risk Rating a- - - - -

Risk Rating bb- - 12,056 - 12,056

Risk Rating b+ - - - -

Risk Rating ccc+ - 1,220 - 1,220

Risk Rating ccc- - 190,146 - 190,146

- 203,422 - 203,422

2,056,461 662,358 2,017,855 4,736,674