Page 213 - EXIM_ IAR24_EBook

P. 213

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 211

NOTES TO THE FINANCIAL STATEMENTS

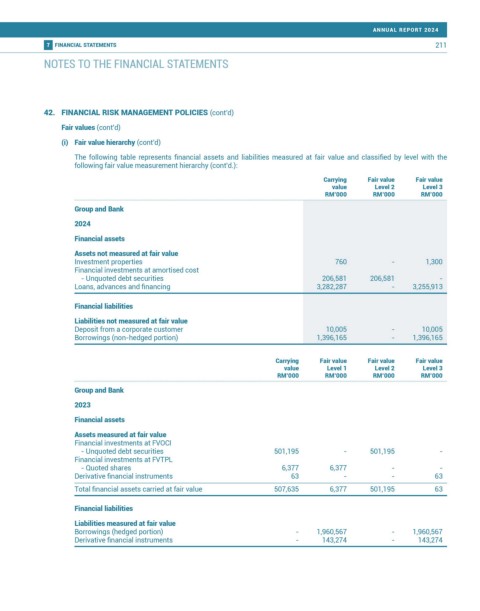

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Fair values (cont’d)

(i) Fair value hierarchy (cont’d)

The following table represents financial assets and liabilities measured at fair value and classified by level with the

following fair value measurement hierarchy (cont’d.):

Carrying Fair value Fair value

value Level 2 Level 3

RM’000 RM’000 RM’000

Group and Bank

2024

Financial assets

Assets not measured at fair value

Investment properties 760 - 1,300

Financial investments at amortised cost

- Unquoted debt securities 206,581 206,581 -

Loans, advances and financing 3,282,287 - 3,255,913

Financial liabilities

Liabilities not measured at fair value

Deposit from a corporate customer 10,005 - 10,005

Borrowings (non-hedged portion) 1,396,165 - 1,396,165

Carrying Fair value Fair value Fair value

value Level 1 Level 2 Level 3

RM’000 RM’000 RM’000 RM’000

Group and Bank

2023

Financial assets

Assets measured at fair value

Financial investments at FVOCI

- Unquoted debt securities 501,195 - 501,195 -

Financial investments at FVTPL

- Quoted shares 6,377 6,377 - -

Derivative financial instruments 63 - - 63

Total financial assets carried at fair value 507,635 6,377 501,195 63

Financial liabilities

Liabilities measured at fair value

Borrowings (hedged portion) - 1,960,567 - 1,960,567

Derivative financial instruments - 143,274 - 143,274