Page 209 - EXIM_ IAR24_EBook

P. 209

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 207

NOTES TO THE FINANCIAL STATEMENTS

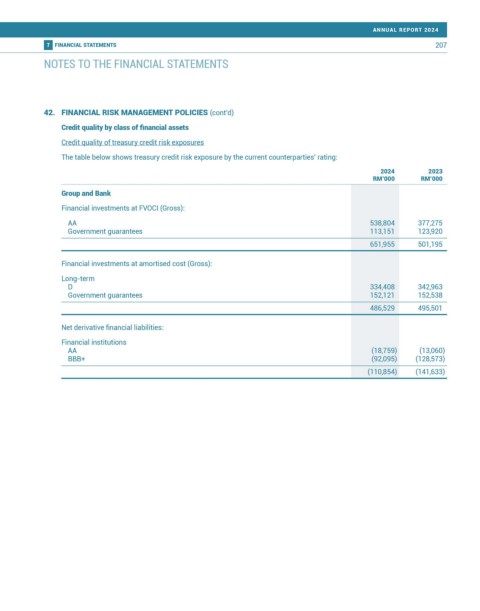

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Credit quality by class of financial assets

Credit quality of treasury credit risk exposures

The table below shows treasury credit risk exposure by the current counterparties’ rating:

2024 2023

RM’000 RM’000

Group and Bank

Financial investments at FVOCI (Gross):

AA 538,804 377,275

Government guarantees 113,151 123,920

651,955 501,195

Financial investments at amortised cost (Gross):

Long-term

D 334,408 342,963

Government guarantees 152,121 152,538

486,529 495,501

Net derivative financial liabilities:

Financial institutions

AA (18,759) (13,060)

BBB+ (92,095) (128,573)

(110,854) (141,633)