Page 214 - EXIM_ IAR24_EBook

P. 214

EXIM BANK MALAYSIA

212

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Fair values (cont’d)

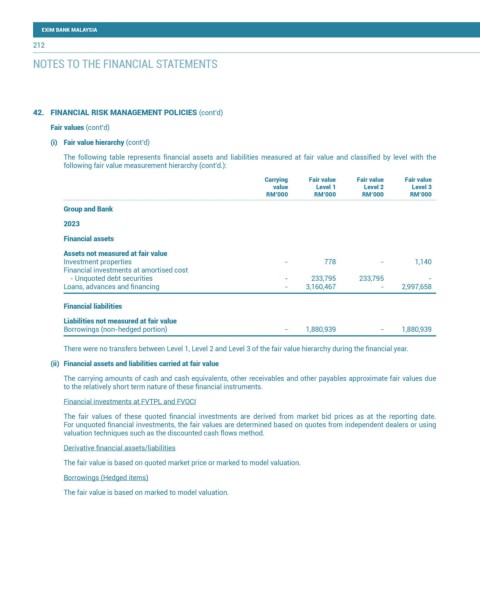

(i) Fair value hierarchy (cont’d)

The following table represents financial assets and liabilities measured at fair value and classified by level with the

following fair value measurement hierarchy (cont’d.):

Carrying Fair value Fair value Fair value

value Level 1 Level 2 Level 3

RM’000 RM’000 RM’000 RM’000

Group and Bank

2023

Financial assets

Assets not measured at fair value

Investment properties - 778 - 1,140

Financial investments at amortised cost

- Unquoted debt securities - 233,795 233,795 -

Loans, advances and financing - 3,160,467 - 2,997,658

Financial liabilities

Liabilities not measured at fair value

Borrowings (non-hedged portion) - 1,880,939 - 1,880,939

There were no transfers between Level 1, Level 2 and Level 3 of the fair value hierarchy during the financial year.

(ii) Financial assets and liabilities carried at fair value

The carrying amounts of cash and cash equivalents, other receivables and other payables approximate fair values due

to the relatively short term nature of these financial instruments.

Financial investments at FVTPL and FVOCI

The fair values of these quoted financial investments are derived from market bid prices as at the reporting date.

For unquoted financial investments, the fair values are determined based on quotes from independent dealers or using

valuation techniques such as the discounted cash flows method.

Derivative financial assets/liabilities

The fair value is based on quoted market price or marked to model valuation.

Borrowings (Hedged items)

The fair value is based on marked to model valuation.