Page 220 - EXIM_ IAR24_EBook

P. 220

EXIM BANK MALAYSIA

218

NOTES TO THE FINANCIAL STATEMENTS

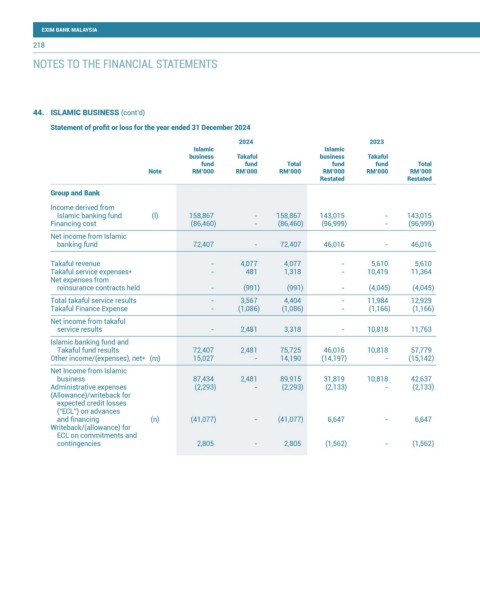

44. ISLAMIC BUSINESS (cont’d)

Statement of profit or loss for the year ended 31 December 2024

2024 2023

Islamic Islamic

business Takaful business Takaful

fund fund Total fund fund Total

Note RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Restated Restated

Group and Bank

Income derived from

Islamic banking fund (l) 158,867 - 158,867 143,015 - 143,015

Financing cost (86,460) - (86,460) (96,999) - (96,999)

Net income from Islamic

banking fund 72,407 - 72,407 46,016 - 46,016

Takaful revenue - 4,077 4,077 - 5,610 5,610

Takaful service expenses* - 481 1,318 - 10,419 11,364

Net expenses from

reinsurance contracts held - (991) (991) - (4,045) (4,045)

Total takaful service results - 3,567 4,404 - 11,984 12,929

Takaful Finance Expense - (1,086) (1,086) - (1,166) (1,166)

Net income from takaful

service results - 2,481 3,318 - 10,818 11,763

Islamic banking fund and

Takaful fund results 72,407 2,481 75,725 46,016 10,818 57,779

Other income/(expenses), net* (m) 15,027 - 14,190 (14,197) - (15,142)

Net Income from Islamic

business 87,434 2,481 89,915 31,819 10,818 42,637

Administrative expenses (2,293) - (2,293) (2,133) - (2,133)

(Allowance)/writeback for

expected credit losses

(“ECL”) on advances

and financing (n) (41,077) - (41,077) 6,647 - 6,647

Writeback/(allowance) for

ECL on commitments and

contingencies 2,805 - 2,805 (1,562) - (1,562)