Page 223 - EXIM_ IAR24_EBook

P. 223

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 221

NOTES TO THE FINANCIAL STATEMENTS

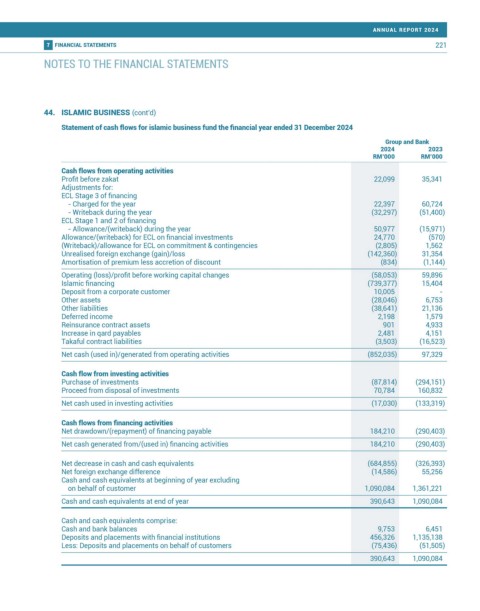

44. ISLAMIC BUSINESS (cont’d)

Statement of cash flows for islamic business fund the financial year ended 31 December 2024

Group and Bank

2024 2023

RM’000 RM’000

Cash flows from operating activities

Profit before zakat 22,099 35,341

Adjustments for:

ECL Stage 3 of financing

- Charged for the year 22,397 60,724

- Writeback during the year (32,297) (51,400)

ECL Stage 1 and 2 of financing

- Allowance/(writeback) during the year 50,977 (15,971)

Allowance/(writeback) for ECL on financial investments 24,770 (570)

(Writeback)/allowance for ECL on commitment & contingencies (2,805) 1,562

Unrealised foreign exchange (gain)/loss (142,360) 31,354

Amortisation of premium less accretion of discount (834) (1,144)

Operating (loss)/profit before working capital changes (58,053) 59,896

Islamic financing (739,377) 15,404

Deposit from a corporate customer 10,005 -

Other assets (28,046) 6,753

Other liabilities (38,641) 21,136

Deferred income 2,198 1,579

Reinsurance contract assets 901 4,933

Increase in qard payables 2,481 4,151

Takaful contract liabilities (3,503) (16,523)

Net cash (used in)/generated from operating activities (852,035) 97,329

Cash flow from investing activities

Purchase of investments (87,814) (294,151)

Proceed from disposal of investments 70,784 160,832

Net cash used in investing activities (17,030) (133,319)

Cash flows from financing activities

Net drawdown/(repayment) of financing payable 184,210 (290,403)

Net cash generated from/(used in) financing activities 184,210 (290,403)

Net decrease in cash and cash equivalents (684,855) (326,393)

Net foreign exchange difference (14,586) 55,256

Cash and cash equivalents at beginning of year excluding

on behalf of customer 1,090,084 1,361,221

Cash and cash equivalents at end of year 390,643 1,090,084

Cash and cash equivalents comprise:

Cash and bank balances 9,753 6,451

Deposits and placements with financial institutions 456,326 1,135,138

Less: Deposits and placements on behalf of customers (75,436) (51,505)

390,643 1,090,084