Page 227 - EXIM_ IAR24_EBook

P. 227

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 225

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

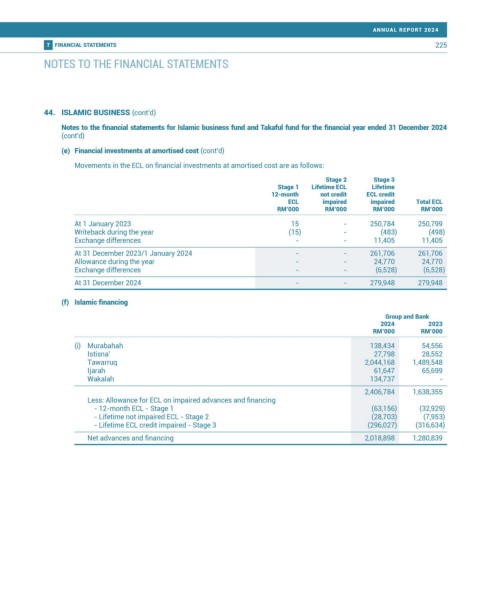

(e) Financial investments at amortised cost (cont’d)

Movements in the ECL on financial investments at amortised cost are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

At 1 January 2023 15 - 250,784 250,799

Writeback during the year (15) - (483) (498)

Exchange differences - - 11,405 11,405

At 31 December 2023/1 January 2024 - - 261,706 261,706

Allowance during the year - - 24,770 24,770

Exchange differences - - (6,528) (6,528)

At 31 December 2024 - - 279,948 279,948

(f) Islamic financing

Group and Bank

2024 2023

RM’000 RM’000

(i) Murabahah 138,434 54,556

Istisna’ 27,798 28,552

Tawarruq 2,044,168 1,489,548

Ijarah 61,647 65,699

Wakalah 134,737 -

2,406,784 1,638,355

Less: Allowance for ECL on impaired advances and financing

- 12-month ECL - Stage 1 (63,156) (32,929)

- Lifetime not impaired ECL - Stage 2 (28,703) (7,953)

- Lifetime ECL credit impaired - Stage 3 (296,027) (316,634)

Net advances and financing 2,018,898 1,280,839