Page 225 - EXIM_ IAR24_EBook

P. 225

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 223

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

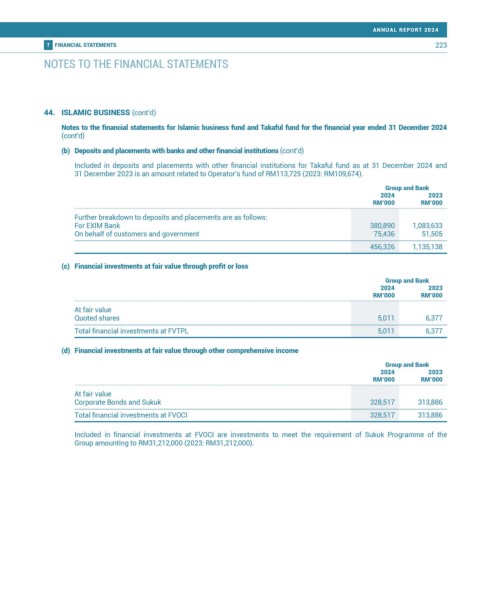

(b) Deposits and placements with banks and other financial institutions (cont’d)

Included in deposits and placements with other financial institutions for Takaful fund as at 31 December 2024 and

31 December 2023 is an amount related to Operator’s fund of RM113,725 (2023: RM109,674).

Group and Bank

2024 2023

RM’000 RM’000

Further breakdown to deposits and placements are as follows:

For EXIM Bank 380,890 1,083,633

On behalf of customers and government 75,436 51,505

456,326 1,135,138

(c) Financial investments at fair value through profit or loss

Group and Bank

2024 2023

RM’000 RM’000

At fair value

Quoted shares 5,011 6,377

Total financial investments at FVTPL 5,011 6,377

(d) Financial investments at fair value through other comprehensive income

Group and Bank

2024 2023

RM’000 RM’000

At fair value

Corporate Bonds and Sukuk 328,517 313,886

Total financial investments at FVOCI 328,517 313,886

Included in financial investments at FVOCI are investments to meet the requirement of Sukuk Programme of the

Group amounting to RM31,212,000 (2023: RM31,212,000).