Page 226 - EXIM_ IAR24_EBook

P. 226

EXIM BANK MALAYSIA

224

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

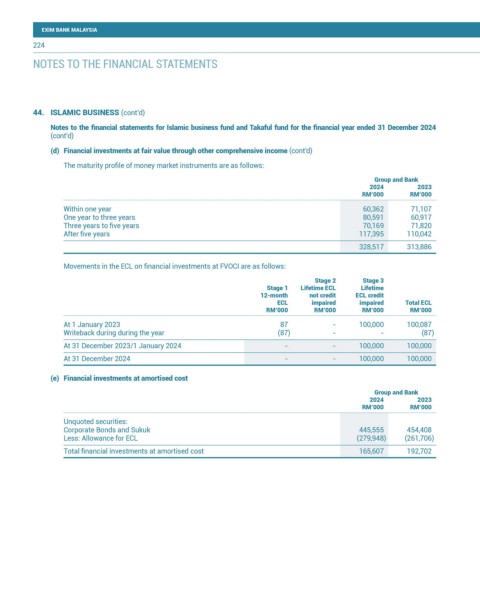

(d) Financial investments at fair value through other comprehensive income (cont’d)

The maturity profile of money market instruments are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Within one year 60,362 71,107

One year to three years 80,591 60,917

Three years to five years 70,169 71,820

After five years 117,395 110,042

328,517 313,886

Movements in the ECL on financial investments at FVOCI are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

At 1 January 2023 87 - 100,000 100,087

Writeback during during the year (87) - - (87)

At 31 December 2023/1 January 2024 - - 100,000 100,000

At 31 December 2024 - - 100,000 100,000

(e) Financial investments at amortised cost

Group and Bank

2024 2023

RM’000 RM’000

Unquoted securities:

Corporate Bonds and Sukuk 445,555 454,408

Less: Allowance for ECL (279,948) (261,706)

Total financial investments at amortised cost 165,607 192,702