Page 141 - EXIM_ IAR24_EBook

P. 141

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 139

NOTES TO THE FINANCIAL STATEMENTS

3. SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENT (cont’d)

(c) Uncertainty in accounting estimates for liabilities of insurance business (Note 43) (cont’d)

The estimates of insurance/takaful contract liabilities are therefore sensitive to various factors and uncertainties.

The establishment of technical provisions in an inherently uncertain process and, as a consequence of this uncertainty,

the eventual collection of premium/contribution and payment of claims may vary from the initial estimates.

There may be significant reporting lags between the occurrence of an insured event and the time it is actually reported.

Following the identification and notification of an insured loss, there may still be uncertainty as to the magnitude of

the claim. There are many factors that will determine the level of uncertainty such as inflation, inconsistent judicial

interpretations, legislative changes and claims handling procedures.

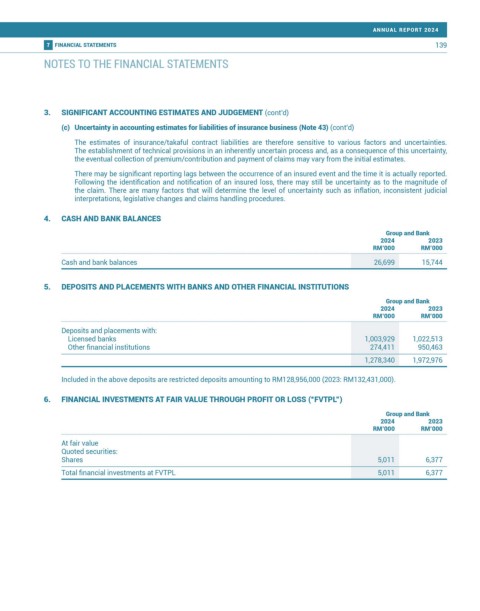

4. CASH AND BANK BALANCES

Group and Bank

2024 2023

RM’000 RM’000

Cash and bank balances 26,699 15,744

5. DEPOSITS AND PLACEMENTS WITH BANKS AND OTHER FINANCIAL INSTITUTIONS

Group and Bank

2024 2023

RM’000 RM’000

Deposits and placements with:

Licensed banks 1,003,929 1,022,513

Other financial institutions 274,411 950,463

1,278,340 1,972,976

Included in the above deposits are restricted deposits amounting to RM128,956,000 (2023: RM132,431,000).

6. FINANCIAL INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS (“FVTPL”)

Group and Bank

2024 2023

RM’000 RM’000

At fair value

Quoted securities:

Shares 5,011 6,377

Total financial investments at FVTPL 5,011 6,377