Page 143 - EXIM_ IAR24_EBook

P. 143

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 141

NOTES TO THE FINANCIAL STATEMENTS

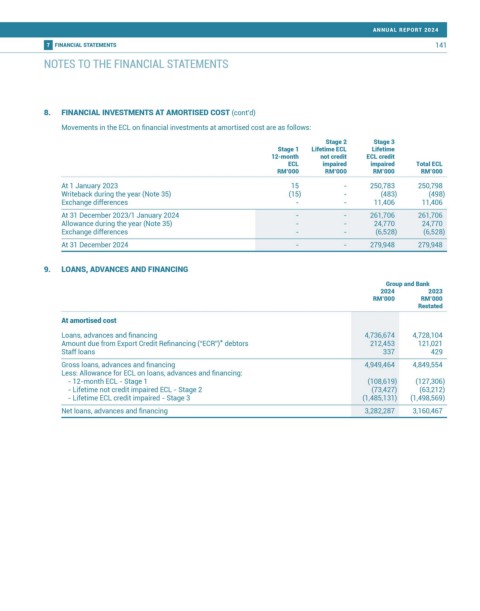

8. FINANCIAL INVESTMENTS AT AMORTISED COST (cont’d)

Movements in the ECL on financial investments at amortised cost are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

At 1 January 2023 15 - 250,783 250,798

Writeback during the year (Note 35) (15) - (483) (498)

Exchange differences - - 11,406 11,406

At 31 December 2023/1 January 2024 - - 261,706 261,706

Allowance during the year (Note 35) - - 24,770 24,770

Exchange differences - - (6,528) (6,528)

At 31 December 2024 - - 279,948 279,948

9. LOANS, ADVANCES AND FINANCING

Group and Bank

2024 2023

RM’000 RM’000

Restated

At amortised cost

Loans, advances and financing 4,736,674 4,728,104

*

Amount due from Export Credit Refinancing (“ECR”) debtors 212,453 121,021

Staff loans 337 429

Gross loans, advances and financing 4,949,464 4,849,554

Less: Allowance for ECL on loans, advances and financing:

- 12-month ECL - Stage 1 (108,619) (127,306)

- Lifetime not credit impaired ECL - Stage 2 (73,427) (63,212)

- Lifetime ECL credit impaired - Stage 3 (1,485,131) (1,498,569)

Net loans, advances and financing 3,282,287 3,160,467