Page 148 - EXIM_ IAR24_EBook

P. 148

EXIM BANK MALAYSIA

146

NOTES TO THE FINANCIAL STATEMENTS

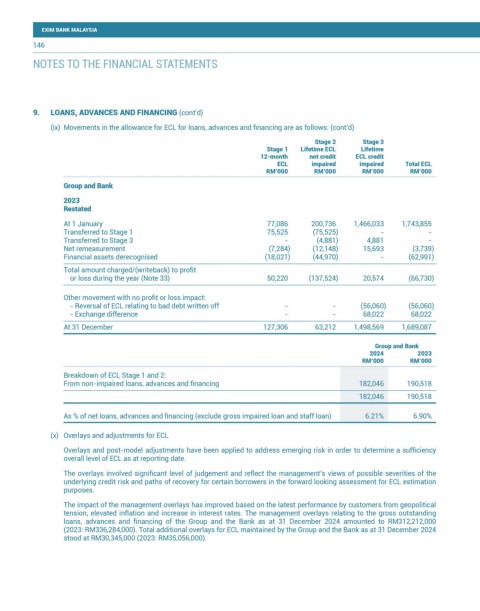

9. LOANS, ADVANCES AND FINANCING (cont’d)

(ix) Movements in the allowance for ECL for loans, advances and financing are as follows: (cont’d)

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

Group and Bank

2023

Restated

At 1 January 77,086 200,736 1,466,033 1,743,855

Transferred to Stage 1 75,525 (75,525) - -

Transferred to Stage 3 - (4,881) 4,881 -

Net remeasurement (7,284) (12,148) 15,693 (3,739)

Financial assets derecognised (18,021) (44,970) - (62,991)

Total amount charged/(writeback) to profit

or loss during the year (Note 33) 50,220 (137,524) 20,574 (66,730)

Other movement with no profit or loss impact:

- Reversal of ECL relating to bad debt written off - - (56,060) (56,060)

- Exchange difference - - 68,022 68,022

At 31 December 127,306 63,212 1,498,569 1,689,087

Group and Bank

2024 2023

RM’000 RM’000

Breakdown of ECL Stage 1 and 2:

From non-impaired loans, advances and financing 182,046 190,518

182,046 190,518

As % of net loans, advances and financing (exclude gross impaired loan and staff loan) 6.21% 6.90%

(x) Overlays and adjustments for ECL

Overlays and post-model adjustments have been applied to address emerging risk in order to determine a sufficiency

overall level of ECL as at reporting date.

The overlays involved significant level of judgement and reflect the management’s views of possible severities of the

underlying credit risk and paths of recovery for certain borrowers in the forward looking assessment for ECL estimation

purposes.

The impact of the management overlays has improved based on the latest performance by customers from geopolitical

tension, elevated inflation and increase in interest rates. The management overlays relating to the gross outstanding

loans, advances and financing of the Group and the Bank as at 31 December 2024 amounted to RM312,212,000

(2023: RM336,284,000). Total additional overlays for ECL maintained by the Group and the Bank as at 31 December 2024

stood at RM30,345,000 (2023: RM35,056,000).