Page 153 - EXIM_ IAR24_EBook

P. 153

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 151

NOTES TO THE FINANCIAL STATEMENTS

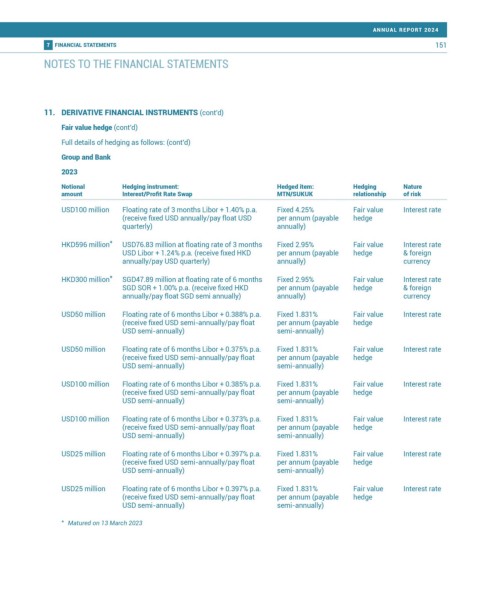

11. DERIVATIVE FINANCIAL INSTRUMENTS (cont’d)

Fair value hedge (cont’d)

Full details of hedging as follows: (cont’d)

Group and Bank

2023

Notional Hedging instrument: Hedged item: Hedging Nature

amount Interest/Profit Rate Swap MTN/SUKUK relationship of risk

USD100 million Floating rate of 3 months Libor + 1.40% p.a. Fixed 4.25% Fair value Interest rate

(receive fixed USD annually/pay float USD per annum (payable hedge

quarterly) annually)

HKD596 million * USD76.83 million at floating rate of 3 months Fixed 2.95% Fair value Interest rate

USD Libor + 1.24% p.a. (receive fixed HKD per annum (payable hedge & foreign

annually/pay USD quarterly) annually) currency

HKD300 million * SGD47.89 million at floating rate of 6 months Fixed 2.95% Fair value Interest rate

SGD SOR + 1.00% p.a. (receive fixed HKD per annum (payable hedge & foreign

annually/pay float SGD semi annually) annually) currency

USD50 million Floating rate of 6 months Libor + 0.388% p.a. Fixed 1.831% Fair value Interest rate

(receive fixed USD semi-annually/pay float per annum (payable hedge

USD semi-annually) semi-annually)

USD50 million Floating rate of 6 months Libor + 0.375% p.a. Fixed 1.831% Fair value Interest rate

(receive fixed USD semi-annually/pay float per annum (payable hedge

USD semi-annually) semi-annually)

USD100 million Floating rate of 6 months Libor + 0.385% p.a. Fixed 1.831% Fair value Interest rate

(receive fixed USD semi-annually/pay float per annum (payable hedge

USD semi-annually) semi-annually)

USD100 million Floating rate of 6 months Libor + 0.373% p.a. Fixed 1.831% Fair value Interest rate

(receive fixed USD semi-annually/pay float per annum (payable hedge

USD semi-annually) semi-annually)

USD25 million Floating rate of 6 months Libor + 0.397% p.a. Fixed 1.831% Fair value Interest rate

(receive fixed USD semi-annually/pay float per annum (payable hedge

USD semi-annually) semi-annually)

USD25 million Floating rate of 6 months Libor + 0.397% p.a. Fixed 1.831% Fair value Interest rate

(receive fixed USD semi-annually/pay float per annum (payable hedge

USD semi-annually) semi-annually)

* Matured on 13 March 2023