Page 156 - EXIM_ IAR24_EBook

P. 156

EXIM BANK MALAYSIA

154

NOTES TO THE FINANCIAL STATEMENTS

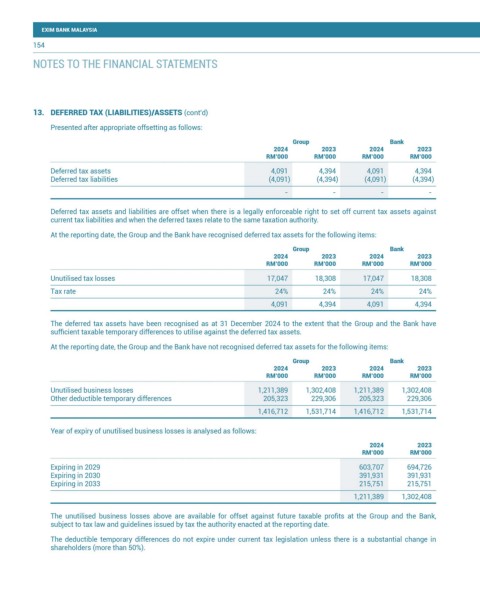

13. DEFERRED TAX (LIABILITIES)/ASSETS (cont’d)

Presented after appropriate offsetting as follows:

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Deferred tax assets 4,091 4,394 4,091 4,394

Deferred tax liabilities (4,091) (4,394) (4,091) (4,394)

- - - -

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against

current tax liabilities and when the deferred taxes relate to the same taxation authority.

At the reporting date, the Group and the Bank have recognised deferred tax assets for the following items:

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Unutilised tax losses 17,047 18,308 17,047 18,308

Tax rate 24% 24% 24% 24%

4,091 4,394 4,091 4,394

The deferred tax assets have been recognised as at 31 December 2024 to the extent that the Group and the Bank have

sufficient taxable temporary differences to utilise against the deferred tax assets.

At the reporting date, the Group and the Bank have not recognised deferred tax assets for the following items:

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Unutilised business losses 1,211,389 1,302,408 1,211,389 1,302,408

Other deductible temporary differences 205,323 229,306 205,323 229,306

1,416,712 1,531,714 1,416,712 1,531,714

Year of expiry of unutilised business losses is analysed as follows:

2024 2023

RM’000 RM’000

Expiring in 2029 603,707 694,726

Expiring in 2030 391,931 391,931

Expiring in 2033 215,751 215,751

1,211,389 1,302,408

The unutilised business losses above are available for offset against future taxable profits at the Group and the Bank,

subject to tax law and guidelines issued by tax the authority enacted at the reporting date.

The deductible temporary differences do not expire under current tax legislation unless there is a substantial change in

shareholders (more than 50%).