Page 158 - EXIM_ IAR24_EBook

P. 158

EXIM BANK MALAYSIA

156

NOTES TO THE FINANCIAL STATEMENTS

15. INVESTMENT PROPERTIES (cont’d)

The investment properties were mainly valued by Raine & Horne International Zaki & Partners Sdn. Bhd., an independent

professional valuer, on 10 February 2025. The fair value is determined based on the comparison method of valuation.

This method of valuation seeks to determine the value of the properties being valued by comparing and adopting as a yardstick

recent transactions and sale evidences involving similar properties in the vicinity.

The Group has no restrictions on the realisability of its investment properties and no contractual obligations to purchase,

construct or develop investment properties or for repairs, maintenance and enhancements.

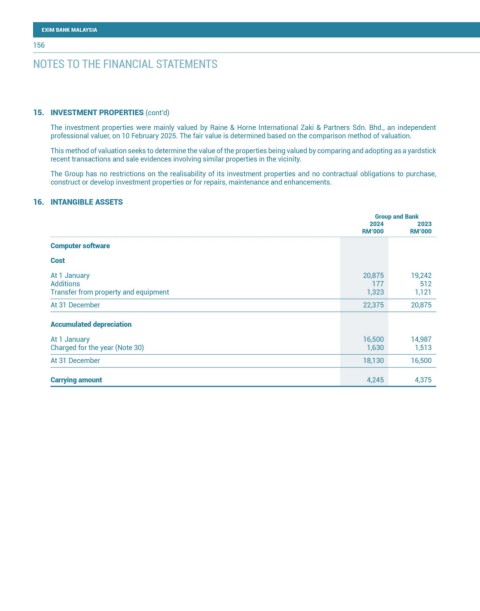

16. INTANGIBLE ASSETS

Group and Bank

2024 2023

RM’000 RM’000

Computer software

Cost

At 1 January 20,875 19,242

Additions 177 512

Transfer from property and equipment 1,323 1,121

At 31 December 22,375 20,875

Accumulated depreciation

At 1 January 16,500 14,987

Charged for the year (Note 30) 1,630 1,513

At 31 December 18,130 16,500

Carrying amount 4,245 4,375