Page 163 - EXIM_ IAR24_EBook

P. 163

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 161

NOTES TO THE FINANCIAL STATEMENTS

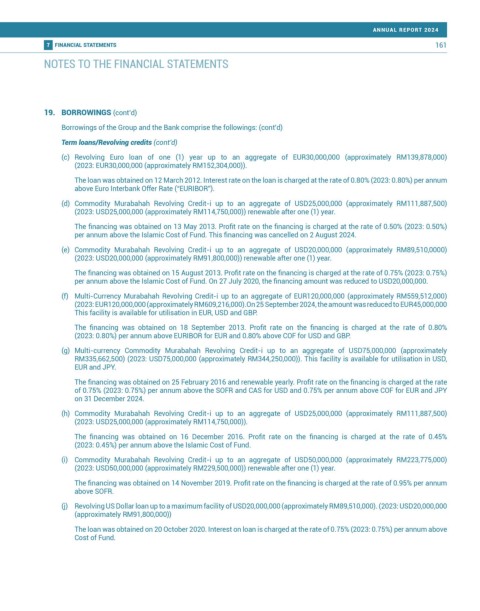

19. BORROWINGS (cont’d)

Borrowings of the Group and the Bank comprise the followings: (cont’d)

Term loans/Revolving credits (cont’d)

(c) Revolving Euro loan of one (1) year up to an aggregate of EUR30,000,000 (approximately RM139,878,000)

(2023: EUR30,000,000 (approximately RM152,304,000)).

The loan was obtained on 12 March 2012. Interest rate on the loan is charged at the rate of 0.80% (2023: 0.80%) per annum

above Euro Interbank Offer Rate (“EURIBOR”).

(d) Commodity Murabahah Revolving Credit-i up to an aggregate of USD25,000,000 (approximately RM111,887,500)

(2023: USD25,000,000 (approximately RM114,750,000)) renewable after one (1) year.

The financing was obtained on 13 May 2013. Profit rate on the financing is charged at the rate of 0.50% (2023: 0.50%)

per annum above the Islamic Cost of Fund. This financing was cancelled on 2 August 2024.

(e) Commodity Murabahah Revolving Credit-i up to an aggregate of USD20,000,000 (approximately RM89,510,0000)

(2023: USD20,000,000 (approximately RM91,800,000)) renewable after one (1) year.

The financing was obtained on 15 August 2013. Profit rate on the financing is charged at the rate of 0.75% (2023: 0.75%)

per annum above the Islamic Cost of Fund. On 27 July 2020, the financing amount was reduced to USD20,000,000.

(f) Multi-Currency Murabahah Revolving Credit-i up to an aggregate of EUR120,000,000 (approximately RM559,512,000)

(2023: EUR120,000,000 (approximately RM609,216,000).On 25 September 2024, the amount was reduced to EUR45,000,000

This facility is available for utilisation in EUR, USD and GBP.

The financing was obtained on 18 September 2013. Profit rate on the financing is charged at the rate of 0.80%

(2023: 0.80%) per annum above EURIBOR for EUR and 0.80% above COF for USD and GBP.

(g) Multi-currency Commodity Murabahah Revolving Credit-i up to an aggregate of USD75,000,000 (approximately

RM335,662,500) (2023: USD75,000,000 (approximately RM344,250,000)). This facility is available for utilisation in USD,

EUR and JPY.

The financing was obtained on 25 February 2016 and renewable yearly. Profit rate on the financing is charged at the rate

of 0.75% (2023: 0.75%) per annum above the SOFR and CAS for USD and 0.75% per annum above COF for EUR and JPY

on 31 December 2024.

(h) Commodity Murabahah Revolving Credit-i up to an aggregate of USD25,000,000 (approximately RM111,887,500)

(2023: USD25,000,000 (approximately RM114,750,000)).

The financing was obtained on 16 December 2016. Profit rate on the financing is charged at the rate of 0.45%

(2023: 0.45%) per annum above the Islamic Cost of Fund.

(i) Commodity Murabahah Revolving Credit-i up to an aggregate of USD50,000,000 (approximately RM223,775,000)

(2023: USD50,000,000 (approximately RM229,500,000)) renewable after one (1) year.

The financing was obtained on 14 November 2019. Profit rate on the financing is charged at the rate of 0.95% per annum

above SOFR.

(j) Revolving US Dollar loan up to a maximum facility of USD20,000,000 (approximately RM89,510,000). (2023: USD20,000,000

(approximately RM91,800,000))

The loan was obtained on 20 October 2020. Interest on loan is charged at the rate of 0.75% (2023: 0.75%) per annum above

Cost of Fund.