Page 161 - EXIM_ IAR24_EBook

P. 161

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 159

NOTES TO THE FINANCIAL STATEMENTS

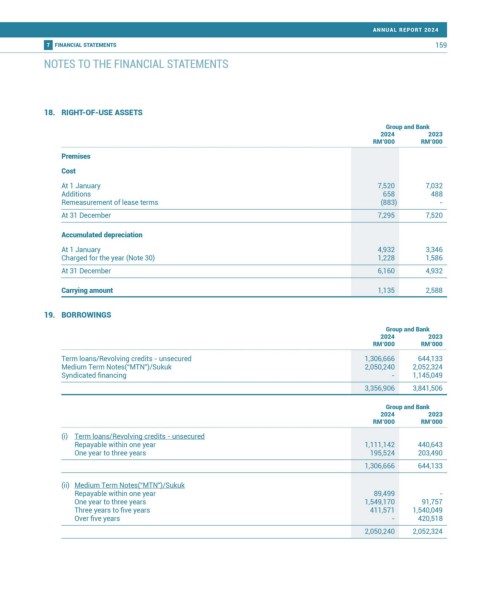

18. RIGHT-OF-USE ASSETS

Group and Bank

2024 2023

RM’000 RM’000

Premises

Cost

At 1 January 7,520 7,032

Additions 658 488

Remeasurement of lease terms (883) -

At 31 December 7,295 7,520

Accumulated depreciation

At 1 January 4,932 3,346

Charged for the year (Note 30) 1,228 1,586

At 31 December 6,160 4,932

Carrying amount 1,135 2,588

19. BORROWINGS

Group and Bank

2024 2023

RM’000 RM’000

Term loans/Revolving credits - unsecured 1,306,666 644,133

Medium Term Notes(“MTN”)/Sukuk 2,050,240 2,052,324

Syndicated financing - 1,145,049

3,356,906 3,841,506

Group and Bank

2024 2023

RM’000 RM’000

(i) Term loans/Revolving credits - unsecured

Repayable within one year 1,111,142 440,643

One year to three years 195,524 203,490

1,306,666 644,133

(ii) Medium Term Notes(“MTN”)/Sukuk

Repayable within one year 89,499 -

One year to three years 1,549,170 91,757

Three years to five years 411,571 1,540,049

Over five years - 420,518

2,050,240 2,052,324