Page 162 - EXIM_ IAR24_EBook

P. 162

EXIM BANK MALAYSIA

160

NOTES TO THE FINANCIAL STATEMENTS

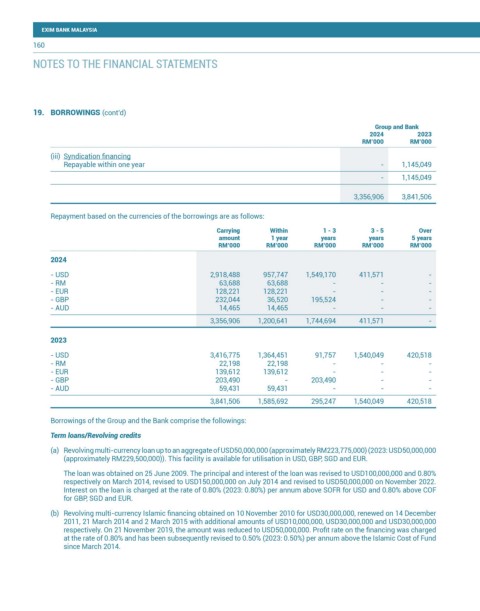

19. BORROWINGS (cont’d)

Group and Bank

2024 2023

RM’000 RM’000

(iii) Syndication financing

Repayable within one year - 1,145,049

- 1,145,049

3,356,906 3,841,506

Repayment based on the currencies of the borrowings are as follows:

Carrying Within 1 - 3 3 - 5 Over

amount 1 year years years 5 years

RM’000 RM’000 RM’000 RM’000 RM’000

2024

- USD 2,918,488 957,747 1,549,170 411,571 -

- RM 63,688 63,688 - - -

- EUR 128,221 128,221 - - -

- GBP 232,044 36,520 195,524 - -

- AUD 14,465 14,465 - - -

3,356,906 1,200,641 1,744,694 411,571 -

2023

- USD 3,416,775 1,364,451 91,757 1,540,049 420,518

- RM 22,198 22,198 - - -

- EUR 139,612 139,612 - - -

- GBP 203,490 - 203,490 - -

- AUD 59,431 59,431 - - -

3,841,506 1,585,692 295,247 1,540,049 420,518

Borrowings of the Group and the Bank comprise the followings:

Term loans/Revolving credits

(a) Revolving multi-currency loan up to an aggregate of USD50,000,000 (approximately RM223,775,000) (2023: USD50,000,000

(approximately RM229,500,000)). This facility is available for utilisation in USD, GBP, SGD and EUR.

The loan was obtained on 25 June 2009. The principal and interest of the loan was revised to USD100,000,000 and 0.80%

respectively on March 2014, revised to USD150,000,000 on July 2014 and revised to USD50,000,000 on November 2022.

Interest on the loan is charged at the rate of 0.80% (2023: 0.80%) per annum above SOFR for USD and 0.80% above COF

for GBP, SGD and EUR.

(b) Revolving multi-currency Islamic financing obtained on 10 November 2010 for USD30,000,000, renewed on 14 December

2011, 21 March 2014 and 2 March 2015 with additional amounts of USD10,000,000, USD30,000,000 and USD30,000,000

respectively. On 21 November 2019, the amount was reduced to USD50,000,000. Profit rate on the financing was charged

at the rate of 0.80% and has been subsequently revised to 0.50% (2023: 0.50%) per annum above the Islamic Cost of Fund

since March 2014.