Page 154 - EXIM_ IAR24_EBook

P. 154

EXIM BANK MALAYSIA

152

NOTES TO THE FINANCIAL STATEMENTS

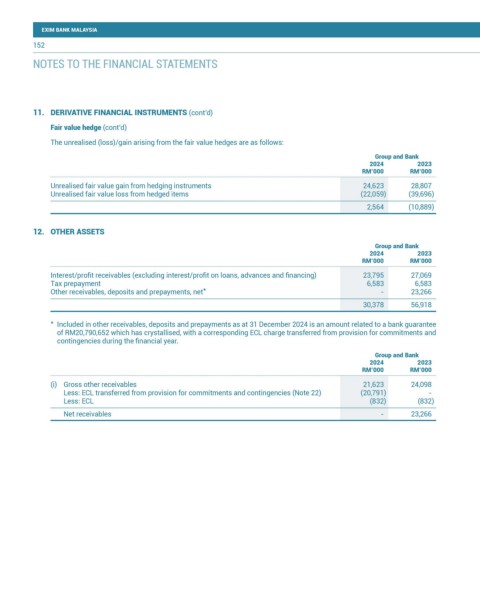

11. DERIVATIVE FINANCIAL INSTRUMENTS (cont’d)

Fair value hedge (cont’d)

The unrealised (loss)/gain arising from the fair value hedges are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Unrealised fair value gain from hedging instruments 24,623 28,807

Unrealised fair value loss from hedged items (22,059) (39,696)

2,564 (10,889)

12. OTHER ASSETS

Group and Bank

2024 2023

RM’000 RM’000

Interest/profit receivables (excluding interest/profit on loans, advances and financing) 23,795 27,069

Tax prepayment 6,583 6,583

*

Other receivables, deposits and prepayments, net - 23,266

30,378 56,918

* Included in other receivables, deposits and prepayments as at 31 December 2024 is an amount related to a bank guarantee

of RM20,790,652 which has crystallised, with a corresponding ECL charge transferred from provision for commitments and

contingencies during the financial year.

Group and Bank

2024 2023

RM’000 RM’000

(i) Gross other receivables 21,623 24,098

Less: ECL transferred from provision for commitments and contingencies (Note 22) (20,791) -

Less: ECL (832) (832)

Net receivables - 23,266