Page 155 - EXIM_ IAR24_EBook

P. 155

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 153

NOTES TO THE FINANCIAL STATEMENTS

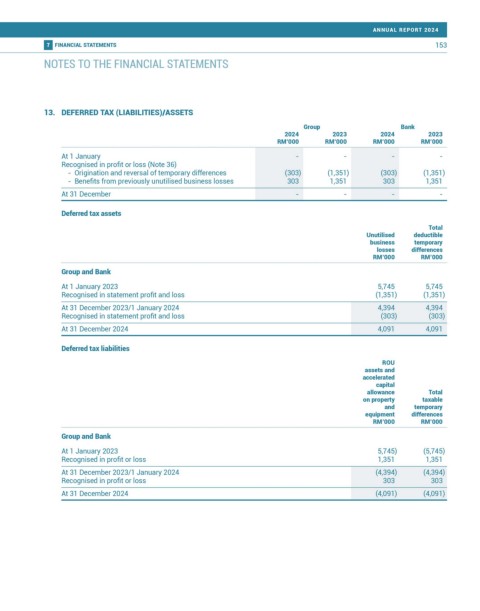

13. DEFERRED TAX (LIABILITIES)/ASSETS

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

At 1 January - - - -

Recognised in profit or loss (Note 36)

- Origination and reversal of temporary differences (303) (1,351) (303) (1,351)

- Benefits from previously unutilised business losses 303 1,351 303 1,351

At 31 December - - - -

Deferred tax assets

Total

Unutilised deductible

business temporary

losses differences

RM’000 RM’000

Group and Bank

At 1 January 2023 5,745 5,745

Recognised in statement profit and loss (1,351) (1,351)

At 31 December 2023/1 January 2024 4,394 4,394

Recognised in statement profit and loss (303) (303)

At 31 December 2024 4,091 4,091

Deferred tax liabilities

ROU

assets and

accelerated

capital

allowance Total

on property taxable

and temporary

equipment differences

RM’000 RM’000

Group and Bank

At 1 January 2023 5,745) (5,745)

Recognised in profit or loss 1,351 1,351

At 31 December 2023/1 January 2024 (4,394) (4,394)

Recognised in profit or loss 303 303

At 31 December 2024 (4,091) (4,091)