Page 147 - EXIM_ IAR24_EBook

P. 147

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 145

NOTES TO THE FINANCIAL STATEMENTS

9. LOANS, ADVANCES AND FINANCING (cont’d)

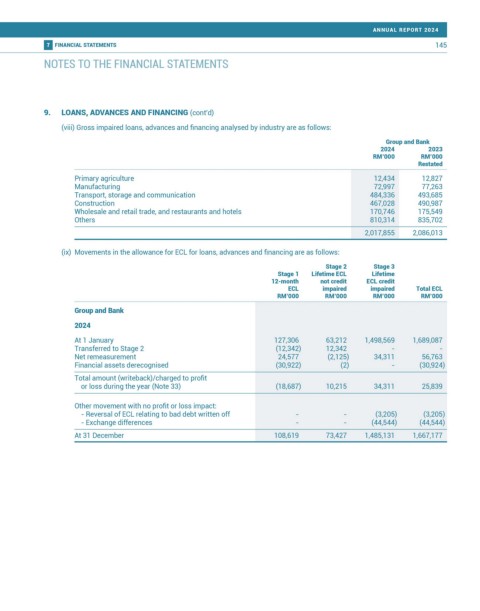

(viii) Gross impaired loans, advances and financing analysed by industry are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Restated

Primary agriculture 12,434 12,827

Manufacturing 72,997 77,263

Transport, storage and communication 484,336 493,685

Construction 467,028 490,987

Wholesale and retail trade, and restaurants and hotels 170,746 175,549

Others 810,314 835,702

2,017,855 2,086,013

(ix) Movements in the allowance for ECL for loans, advances and financing are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

Group and Bank

2024

At 1 January 127,306 63,212 1,498,569 1,689,087

Transferred to Stage 2 (12,342) 12,342 - -

Net remeasurement 24,577 (2,125) 34,311 56,763

Financial assets derecognised (30,922) (2) - (30,924)

Total amount (writeback)/charged to profit

or loss during the year (Note 33) (18,687) 10,215 34,311 25,839

Other movement with no profit or loss impact:

- Reversal of ECL relating to bad debt written off - - (3,205) (3,205)

- Exchange differences - - (44,544) (44,544)

At 31 December 108,619 73,427 1,485,131 1,667,177