Page 146 - EXIM_ IAR24_EBook

P. 146

EXIM BANK MALAYSIA

144

NOTES TO THE FINANCIAL STATEMENTS

9. LOANS, ADVANCES AND FINANCING (cont’d)

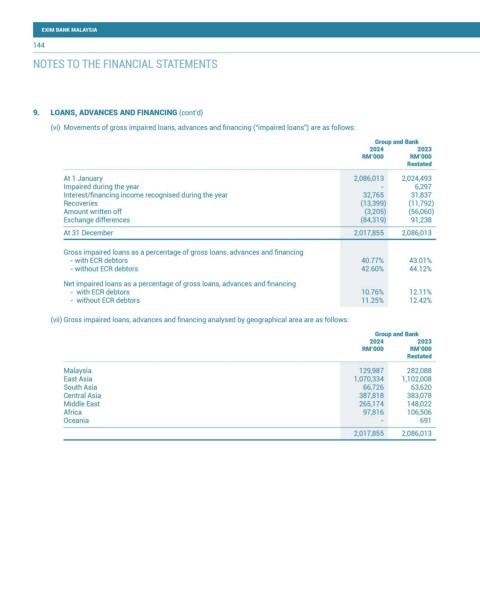

(vi) Movements of gross impaired loans, advances and financing (“impaired loans”) are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Restated

At 1 January 2,086,013 2,024,493

Impaired during the year - 6,297

Interest/financing income recognised during the year 32,765 31,837

Recoveries (13,399) (11,792)

Amount written off (3,205) (56,060)

Exchange differences (84,319) 91,238

At 31 December 2,017,855 2,086,013

Gross impaired loans as a percentage of gross loans, advances and financing

- with ECR debtors 40.77% 43.01%

- without ECR debtors 42.60% 44.12%

Net impaired loans as a percentage of gross loans, advances and financing

- with ECR debtors 10.76% 12.11%

- without ECR debtors 11.25% 12.42%

(vii) Gross impaired loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Restated

Malaysia 129,987 282,088

East Asia 1,070,334 1,102,008

South Asia 66,726 63,620

Central Asia 387,818 383,078

Middle East 265,174 148,022

Africa 97,816 106,506

Oceania - 691

2,017,855 2,086,013