Page 145 - EXIM_ IAR24_EBook

P. 145

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 143

NOTES TO THE FINANCIAL STATEMENTS

9. LOANS, ADVANCES AND FINANCING (cont’d)

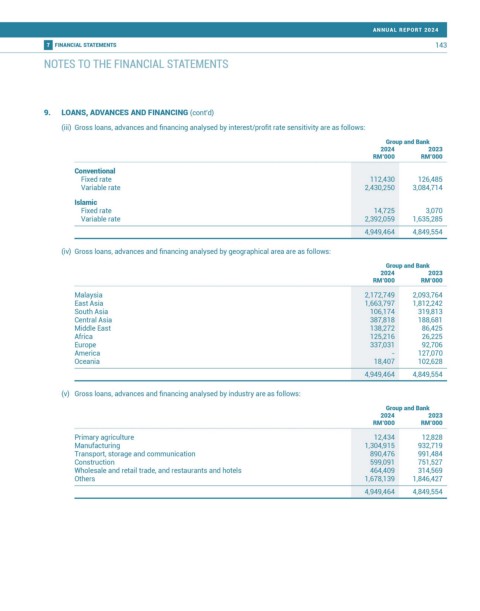

(iii) Gross loans, advances and financing analysed by interest/profit rate sensitivity are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Conventional

Fixed rate 112,430 126,485

Variable rate 2,430,250 3,084,714

Islamic

Fixed rate 14,725 3,070

Variable rate 2,392,059 1,635,285

4,949,464 4,849,554

(iv) Gross loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Malaysia 2,172,749 2,093,764

East Asia 1,663,797 1,812,242

South Asia 106,174 319,813

Central Asia 387,818 188,681

Middle East 138,272 86,425

Africa 125,216 26,225

Europe 337,031 92,706

America - 127,070

Oceania 18,407 102,628

4,949,464 4,849,554

(v) Gross loans, advances and financing analysed by industry are as follows:

Group and Bank

2024 2023

RM’000 RM’000

Primary agriculture 12,434 12,828

Manufacturing 1,304,915 932,719

Transport, storage and communication 890,476 991,484

Construction 599,091 751,527

Wholesale and retail trade, and restaurants and hotels 464,409 314,569

Others 1,678,139 1,846,427

4,949,464 4,849,554