Page 196 - EXIM_ IAR24_EBook

P. 196

EXIM BANK MALAYSIA

194

NOTES TO THE FINANCIAL STATEMENTS

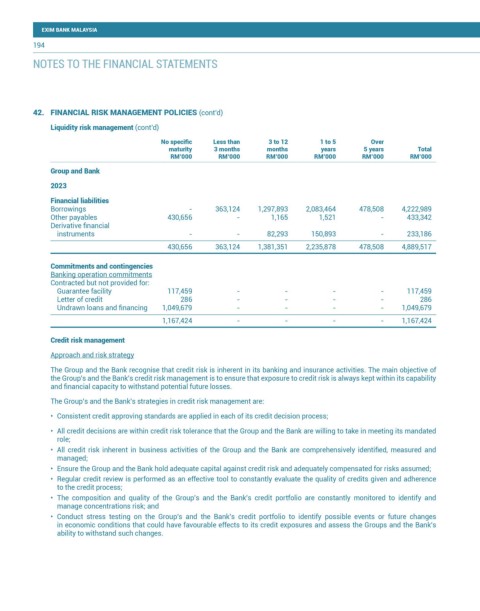

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Liquidity risk management (cont’d)

No specific Less than 3 to 12 1 to 5 Over

maturity 3 months months years 5 years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Group and Bank

2023

Financial liabilities

Borrowings - 363,124 1,297,893 2,083,464 478,508 4,222,989

Other payables 430,656 - 1,165 1,521 - 433,342

Derivative financial

instruments - - 82,293 150,893 - 233,186

430,656 363,124 1,381,351 2,235,878 478,508 4,889,517

Commitments and contingencies

Banking operation commitments

Contracted but not provided for:

Guarantee facility 117,459 - - - - 117,459

Letter of credit 286 - - - - 286

Undrawn loans and financing 1,049,679 - - - - 1,049,679

1,167,424 - - - - 1,167,424

Credit risk management

Approach and risk strategy

The Group and the Bank recognise that credit risk is inherent in its banking and insurance activities. The main objective of

the Group’s and the Bank’s credit risk management is to ensure that exposure to credit risk is always kept within its capability

and financial capacity to withstand potential future losses.

The Group’s and the Bank’s strategies in credit risk management are:

• Consistent credit approving standards are applied in each of its credit decision process;

• All credit decisions are within credit risk tolerance that the Group and the Bank are willing to take in meeting its mandated

role;

• All credit risk inherent in business activities of the Group and the Bank are comprehensively identified, measured and

managed;

• Ensure the Group and the Bank hold adequate capital against credit risk and adequately compensated for risks assumed;

• Regular credit review is performed as an effective tool to constantly evaluate the quality of credits given and adherence

to the credit process;

• The composition and quality of the Group’s and the Bank’s credit portfolio are constantly monitored to identify and

manage concentrations risk; and

• Conduct stress testing on the Group’s and the Bank’s credit portfolio to identify possible events or future changes

in economic conditions that could have favourable effects to its credit exposures and assess the Groups and the Bank’s

ability to withstand such changes.