Page 193 - EXIM_ IAR24_EBook

P. 193

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 191

NOTES TO THE FINANCIAL STATEMENTS

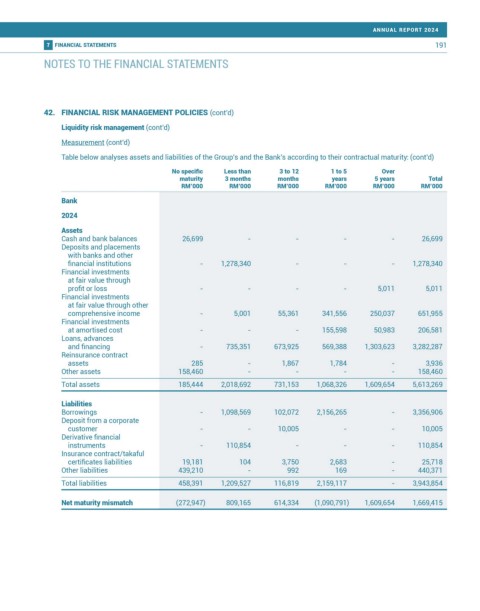

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Liquidity risk management (cont’d)

Measurement (cont’d)

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity: (cont’d)

No specific Less than 3 to 12 1 to 5 Over

maturity 3 months months years 5 years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Bank

2024

Assets

Cash and bank balances 26,699 - - - - 26,699

Deposits and placements

with banks and other

financial institutions - 1,278,340 - - - 1,278,340

Financial investments

at fair value through

profit or loss - - - - 5,011 5,011

Financial investments

at fair value through other

comprehensive income - 5,001 55,361 341,556 250,037 651,955

Financial investments

at amortised cost - - - 155,598 50,983 206,581

Loans, advances

and financing - 735,351 673,925 569,388 1,303,623 3,282,287

Reinsurance contract

assets 285 - 1,867 1,784 - 3,936

Other assets 158,460 - - - - 158,460

Total assets 185,444 2,018,692 731,153 1,068,326 1,609,654 5,613,269

Liabilities

Borrowings - 1,098,569 102,072 2,156,265 - 3,356,906

Deposit from a corporate

customer - - 10,005 - - 10,005

Derivative financial

instruments - 110,854 - - - 110,854

Insurance contract/takaful

certificates liabilities 19,181 104 3,750 2,683 - 25,718

Other liabilities 439,210 - 992 169 - 440,371

Total liabilities 458,391 1,209,527 116,819 2,159,117 - 3,943,854

Net maturity mismatch (272,947) 809,165 614,334 (1,090,791) 1,609,654 1,669,415