Page 190 - EXIM_ IAR24_EBook

P. 190

EXIM BANK MALAYSIA

188

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Asset liability management (cont’d)

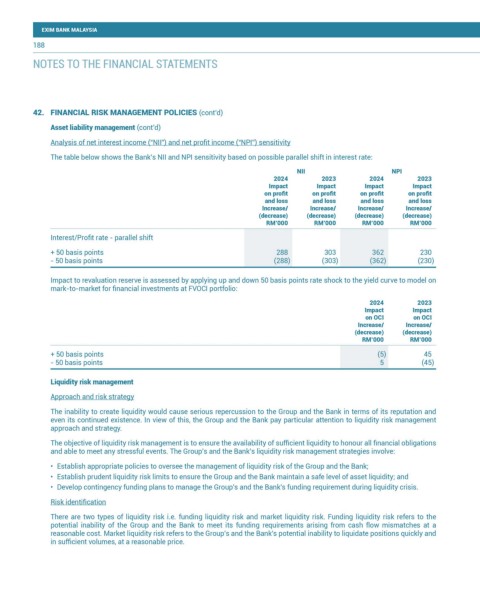

Analysis of net interest income (“NII”) and net profit income (“NPI”) sensitivity

The table below shows the Bank’s NII and NPI sensitivity based on possible parallel shift in interest rate:

NII NPI

2024 2023 2024 2023

Impact Impact Impact Impact

on profit on profit on profit on profit

and loss and loss and loss and loss

Increase/ Increase/ Increase/ Increase/

(decrease) (decrease) (decrease) (decrease)

RM’000 RM’000 RM’000 RM’000

Interest/Profit rate - parallel shift

+ 50 basis points 288 303 362 230

- 50 basis points (288) (303) (362) (230)

Impact to revaluation reserve is assessed by applying up and down 50 basis points rate shock to the yield curve to model on

mark-to-market for financial investments at FVOCI portfolio:

2024 2023

Impact Impact

on OCI on OCI

Increase/ Increase/

(decrease) (decrease)

RM’000 RM’000

+ 50 basis points (5) 45

- 50 basis points 5 (45)

Liquidity risk management

Approach and risk strategy

The inability to create liquidity would cause serious repercussion to the Group and the Bank in terms of its reputation and

even its continued existence. In view of this, the Group and the Bank pay particular attention to liquidity risk management

approach and strategy.

The objective of liquidity risk management is to ensure the availability of sufficient liquidity to honour all financial obligations

and able to meet any stressful events. The Group’s and the Bank’s liquidity risk management strategies involve:

• Establish appropriate policies to oversee the management of liquidity risk of the Group and the Bank;

• Establish prudent liquidity risk limits to ensure the Group and the Bank maintain a safe level of asset liquidity; and

• Develop contingency funding plans to manage the Group’s and the Bank’s funding requirement during liquidity crisis.

Risk identification

There are two types of liquidity risk i.e. funding liquidity risk and market liquidity risk. Funding liquidity risk refers to the

potential inability of the Group and the Bank to meet its funding requirements arising from cash flow mismatches at a

reasonable cost. Market liquidity risk refers to the Group’s and the Bank’s potential inability to liquidate positions quickly and

in sufficient volumes, at a reasonable price.