Page 192 - EXIM_ IAR24_EBook

P. 192

EXIM BANK MALAYSIA

190

NOTES TO THE FINANCIAL STATEMENTS

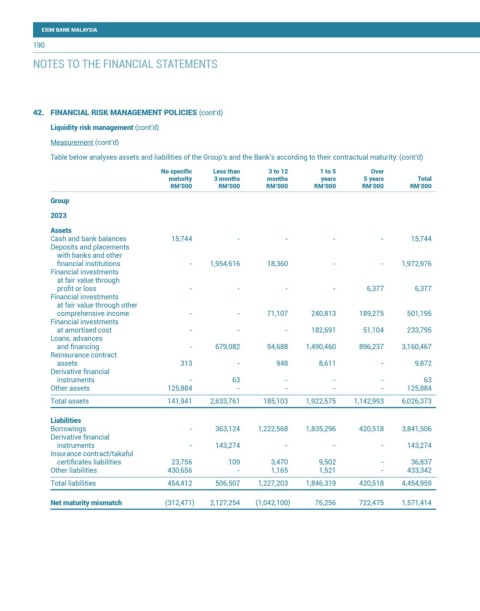

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Liquidity risk management (cont’d)

Measurement (cont’d)

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity: (cont’d)

No specific Less than 3 to 12 1 to 5 Over

maturity 3 months months years 5 years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Group

2023

Assets

Cash and bank balances 15,744 - - - - 15,744

Deposits and placements

with banks and other

financial institutions - 1,954,616 18,360 - - 1,972,976

Financial investments

at fair value through

profit or loss - - - - 6,377 6,377

Financial investments

at fair value through other

comprehensive income - - 71,107 240,813 189,275 501,195

Financial investments

at amortised cost - - - 182,691 51,104 233,795

Loans, advances

and financing - 679,082 94,688 1,490,460 896,237 3,160,467

Reinsurance contract

assets 313 - 948 8,611 - 9,872

Derivative financial

instruments - 63 - - - 63

Other assets 125,884 - - - - 125,884

Total assets 141,941 2,633,761 185,103 1,922,575 1,142,993 6,026,373

Liabilities

Borrowings - 363,124 1,222,568 1,835,296 420,518 3,841,506

Derivative financial

instruments - 143,274 - - - 143,274

Insurance contract/takaful

certificates liabilities 23,756 109 3,470 9,502 - 36,837

Other liabilities 430,656 - 1,165 1,521 - 433,342

Total liabilities 454,412 506,507 1,227,203 1,846,319 420,518 4,454,959

Net maturity mismatch (312,471) 2,127,254 (1,042,100) 76,256 722,475 1,571,414