Page 176 - EXIM_ IAR24_EBook

P. 176

EXIM BANK MALAYSIA

174

NOTES TO THE FINANCIAL STATEMENTS

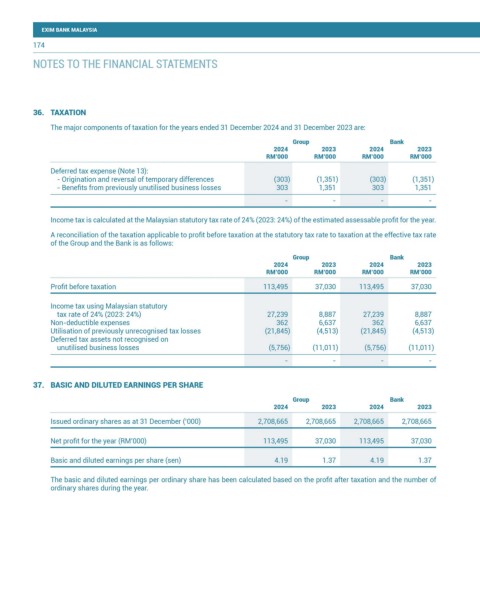

36. TAXATION

The major components of taxation for the years ended 31 December 2024 and 31 December 2023 are:

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Deferred tax expense (Note 13):

- Origination and reversal of temporary differences (303) (1,351) (303) (1,351)

- Benefits from previously unutilised business losses 303 1,351 303 1,351

- - - -

Income tax is calculated at the Malaysian statutory tax rate of 24% (2023: 24%) of the estimated assessable profit for the year.

A reconciliation of the taxation applicable to profit before taxation at the statutory tax rate to taxation at the effective tax rate

of the Group and the Bank is as follows:

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Profit before taxation 113,495 37,030 113,495 37,030

Income tax using Malaysian statutory

tax rate of 24% (2023: 24%) 27,239 8,887 27,239 8,887

Non-deductible expenses 362 6,637 362 6,637

Utilisation of previously unrecognised tax losses (21,845) (4,513) (21,845) (4,513)

Deferred tax assets not recognised on

unutilised business losses (5,756) (11,011) (5,756) (11,011)

- - - -

37. BASIC AND DILUTED EARNINGS PER SHARE

Group Bank

2024 2023 2024 2023

Issued ordinary shares as at 31 December (‘000) 2,708,665 2,708,665 2,708,665 2,708,665

Net profit for the year (RM’000) 113,495 37,030 113,495 37,030

Basic and diluted earnings per share (sen) 4.19 1.37 4.19 1.37

The basic and diluted earnings per ordinary share has been calculated based on the profit after taxation and the number of

ordinary shares during the year.