Page 178 - EXIM_ IAR24_EBook

P. 178

EXIM BANK MALAYSIA

176

NOTES TO THE FINANCIAL STATEMENTS

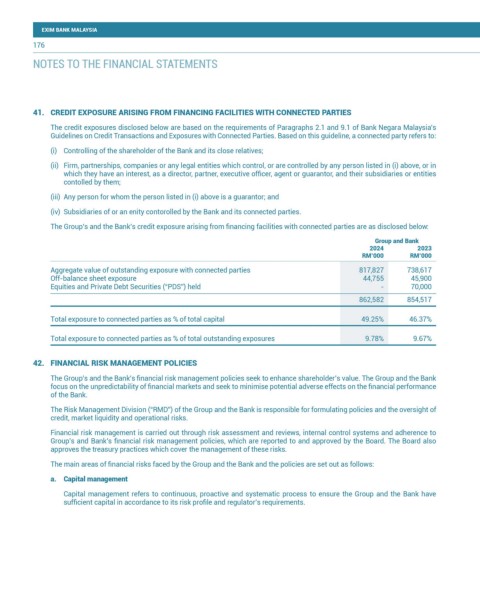

41. CREDIT EXPOSURE ARISING FROM FINANCING FACILITIES WITH CONNECTED PARTIES

The credit exposures disclosed below are based on the requirements of Paragraphs 2.1 and 9.1 of Bank Negara Malaysia’s

Guidelines on Credit Transactions and Exposures with Connected Parties. Based on this guideline, a connected party refers to:

(i) Controlling of the shareholder of the Bank and its close relatives;

(ii) Firm, partnerships, companies or any legal entities which control, or are controlled by any person listed in (i) above, or in

which they have an interest, as a director, partner, executive officer, agent or guarantor, and their subsidiaries or entities

contolled by them;

(iii) Any person for whom the person listed in (i) above is a guarantor; and

(iv) Subsidiaries of or an enity contorolled by the Bank and its connected parties.

The Group’s and the Bank’s credit exposure arising from financing facilities with connected parties are as disclosed below:

Group and Bank

2024 2023

RM’000 RM’000

Aggregate value of outstanding exposure with connected parties 817,827 738,617

Off-balance sheet exposure 44,755 45,900

Equities and Private Debt Securities (“PDS”) held - 70,000

862,582 854,517

Total exposure to connected parties as % of total capital 49.25% 46.37%

Total exposure to connected parties as % of total outstanding exposures 9.78% 9.67%

42. FINANCIAL RISK MANAGEMENT POLICIES

The Group’s and the Bank’s financial risk management policies seek to enhance shareholder’s value. The Group and the Bank

focus on the unpredictability of financial markets and seek to minimise potential adverse effects on the financial performance

of the Bank.

The Risk Management Division (“RMD”) of the Group and the Bank is responsible for formulating policies and the oversight of

credit, market liquidity and operational risks.

Financial risk management is carried out through risk assessment and reviews, internal control systems and adherence to

Group’s and Bank’s financial risk management policies, which are reported to and approved by the Board. The Board also

approves the treasury practices which cover the management of these risks.

The main areas of financial risks faced by the Group and the Bank and the policies are set out as follows:

a. Capital management

Capital management refers to continuous, proactive and systematic process to ensure the Group and the Bank have

sufficient capital in accordance to its risk profile and regulator’s requirements.