Page 183 - EXIM_ IAR24_EBook

P. 183

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 181

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Market risk management (cont’d)

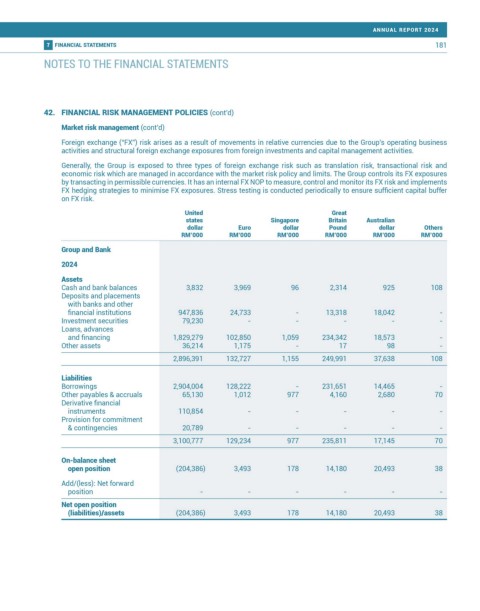

Foreign exchange (“FX”) risk arises as a result of movements in relative currencies due to the Group’s operating business

activities and structural foreign exchange exposures from foreign investments and capital management activities.

Generally, the Group is exposed to three types of foreign exchange risk such as translation risk, transactional risk and

economic risk which are managed in accordance with the market risk policy and limits. The Group controls its FX exposures

by transacting in permissible currencies. It has an internal FX NOP to measure, control and monitor its FX risk and implements

FX hedging strategies to minimise FX exposures. Stress testing is conducted periodically to ensure sufficient capital buffer

on FX risk.

United Great

states Singapore Britain Australian

dollar Euro dollar Pound dollar Others

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Group and Bank

2024

Assets

Cash and bank balances 3,832 3,969 96 2,314 925 108

Deposits and placements

with banks and other

financial institutions 947,836 24,733 - 13,318 18,042 -

Investment securities 79,230 - - - - -

Loans, advances

and financing 1,829,279 102,850 1,059 234,342 18,573 -

Other assets 36,214 1,175 - 17 98 -

2,896,391 132,727 1,155 249,991 37,638 108

Liabilities

Borrowings 2,904,004 128,222 - 231,651 14,465 -

Other payables & accruals 65,130 1,012 977 4,160 2,680 70

Derivative financial

instruments 110,854 - - - - -

Provision for commitment

& contingencies 20,789 - - - - -

3,100,777 129,234 977 235,811 17,145 70

On-balance sheet

open position (204,386) 3,493 178 14,180 20,493 38

Add/(less): Net forward

position - - - - - -

Net open position

(liabilities)/assets (204,386) 3,493 178 14,180 20,493 38