Page 184 - EXIM_ IAR24_EBook

P. 184

EXIM BANK MALAYSIA

182

NOTES TO THE FINANCIAL STATEMENTS

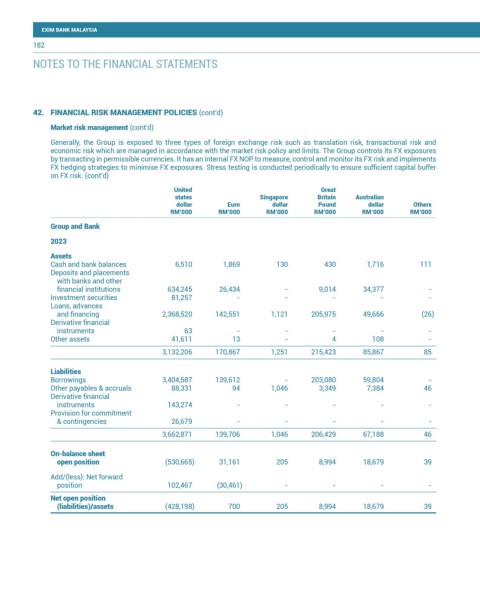

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Market risk management (cont’d)

Generally, the Group is exposed to three types of foreign exchange risk such as translation risk, transactional risk and

economic risk which are managed in accordance with the market risk policy and limits. The Group controls its FX exposures

by transacting in permissible currencies. It has an internal FX NOP to measure, control and monitor its FX risk and implements

FX hedging strategies to minimise FX exposures. Stress testing is conducted periodically to ensure sufficient capital buffer

on FX risk. (cont’d)

United Great

states Singapore Britain Australian

dollar Euro dollar Pound dollar Others

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Group and Bank

2023

Assets

Cash and bank balances 6,510 1,869 130 430 1,716 111

Deposits and placements

with banks and other

financial institutions 634,245 26,434 - 9,014 34,377 -

Investment securities 81,257 - - - - -

Loans, advances

and financing 2,368,520 142,551 1,121 205,975 49,666 (26)

Derivative financial

instruments 63 - - - - -

Other assets 41,611 13 - 4 108 -

3,132,206 170,867 1,251 215,423 85,867 85

Liabilities

Borrowings 3,404,587 139,612 - 203,080 59,804 -

Other payables & accruals 88,331 94 1,046 3,349 7,384 46

Derivative financial

instruments 143,274 - - - - -

Provision for commitment

& contingencies 26,679 - - - - -

3,662,871 139,706 1,046 206,429 67,188 46

On-balance sheet

open position (530,665) 31,161 205 8,994 18,679 39

Add/(less): Net forward

position 102,467 (30,461) - - - -

Net open position

(liabilities)/assets (428,198) 700 205 8,994 18,679 39