Page 181 - EXIM_ IAR24_EBook

P. 181

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 179

NOTES TO THE FINANCIAL STATEMENTS

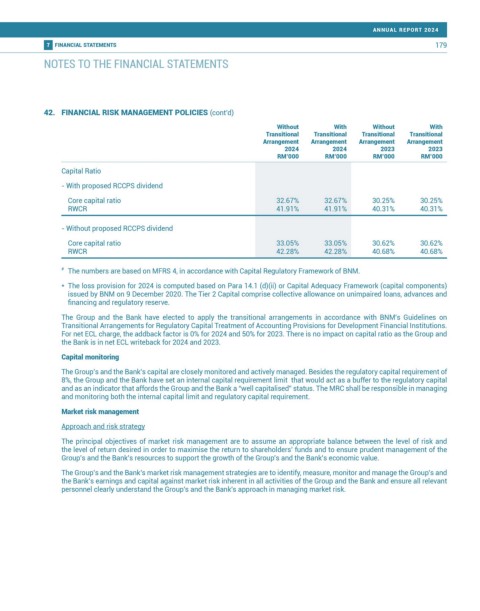

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Without With Without With

Transitional Transitional Transitional Transitional

Arrangement Arrangement Arrangement Arrangement

2024 2024 2023 2023

RM’000 RM’000 RM’000 RM’000

Capital Ratio

- With proposed RCCPS dividend

Core capital ratio 32.67% 32.67% 30.25% 30.25%

RWCR 41.91% 41.91% 40.31% 40.31%

- Without proposed RCCPS dividend

Core capital ratio 33.05% 33.05% 30.62% 30.62%

RWCR 42.28% 42.28% 40.68% 40.68%

# The numbers are based on MFRS 4, in accordance with Capital Regulatory Framework of BNM.

* The loss provision for 2024 is computed based on Para 14.1 (d)(ii) or Capital Adequacy Framework (capital components)

issued by BNM on 9 December 2020. The Tier 2 Capital comprise collective allowance on unimpaired loans, advances and

financing and regulatory reserve.

The Group and the Bank have elected to apply the transitional arrangements in accordance with BNM’s Guidelines on

Transitional Arrangements for Regulatory Capital Treatment of Accounting Provisions for Development Financial Institutions.

For net ECL charge, the addback factor is 0% for 2024 and 50% for 2023. There is no impact on capital ratio as the Group and

the Bank is in net ECL writeback for 2024 and 2023.

Capital monitoring

The Group’s and the Bank’s capital are closely monitored and actively managed. Besides the regulatory capital requirement of

8%, the Group and the Bank have set an internal capital requirement limit that would act as a buffer to the regulatory capital

and as an indicator that affords the Group and the Bank a “well capitalised” status. The MRC shall be responsible in managing

and monitoring both the internal capital limit and regulatory capital requirement.

Market risk management

Approach and risk strategy

The principal objectives of market risk management are to assume an appropriate balance between the level of risk and

the level of return desired in order to maximise the return to shareholders’ funds and to ensure prudent management of the

Group’s and the Bank’s resources to support the growth of the Group’s and the Bank’s economic value.

The Group’s and the Bank’s market risk management strategies are to identify, measure, monitor and manage the Group’s and

the Bank’s earnings and capital against market risk inherent in all activities of the Group and the Bank and ensure all relevant

personnel clearly understand the Group’s and the Bank’s approach in managing market risk.