Page 182 - EXIM_ IAR24_EBook

P. 182

EXIM BANK MALAYSIA

180

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Market risk management (cont’d)

Risk identification

The Group’s and the Bank’s market risk arise due to changes foreign currency which would lead to a decline in the value of the

Group’s and the Bank’s financial investments, derivatives, borrowings, foreign exchange and equity position.

Measurement

The Group’s and the Bank’s policies are to minimise the exposures to foreign currency risk arising from lending activities by

monitoring and obtaining the Board’s approval for funding requisitions that involve foreign currencies.

The Group and the Bank are exposed to foreign currency risk arising from the balances in cash and bank balances, deposits

and placements, loans, advances and financing, derivatives financial instruments and borrowings.

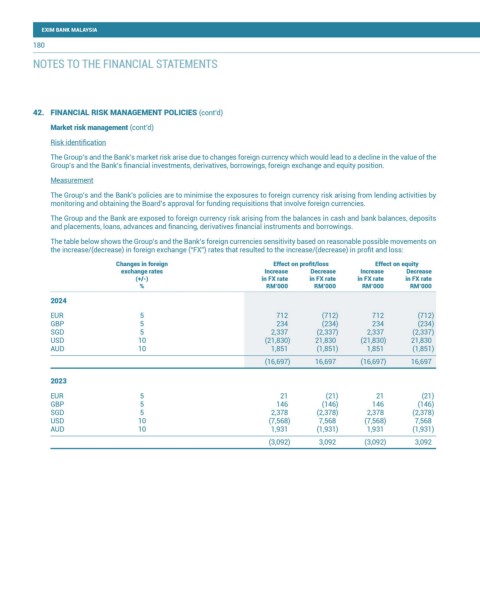

The table below shows the Group’s and the Bank’s foreign currencies sensitivity based on reasonable possible movements on

the increase/(decrease) in foreign exchange (“FX”) rates that resulted to the increase/(decrease) in profit and loss:

Changes in foreign Effect on profit/loss Effect on equity

exchange rates Increase Decrease Increase Decrease

(+/-) in FX rate in FX rate in FX rate in FX rate

% RM’000 RM’000 RM’000 RM’000

2024

EUR 5 712 (712) 712 (712)

GBP 5 234 (234) 234 (234)

SGD 5 2,337 (2,337) 2,337 (2,337)

USD 10 (21,830) 21,830 (21,830) 21,830

AUD 10 1,851 (1,851) 1,851 (1,851)

(16,697) 16,697 (16,697) 16,697

2023

EUR 5 21 (21) 21 (21)

GBP 5 146 (146) 146 (146)

SGD 5 2,378 (2,378) 2,378 (2,378)

USD 10 (7,568) 7,568 (7,568) 7,568

AUD 10 1,931 (1,931) 1,931 (1,931)

(3,092) 3,092 (3,092) 3,092