Page 180 - EXIM_ IAR24_EBook

P. 180

EXIM BANK MALAYSIA

178

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (cont’d)

Capital management

Capital policy

The overall objective of capital management is to maintain a strong capital position in order to provide opportunities for

business growth and able to provide cushion for any potential losses. In line with this objective, the Group and the Bank view

capital position as an important key barometer of financial health.

In order to support its mandated roles, the Group and the Bank must have strong and adequate capital to support its business

activities on an on-going basis. BNM has imposed several regulatory capital requirements whereby, the Bank must have an

absolute minimum capital funds of RM300,000,000 and a minimum Risk Weighted Capital Ratio (“RWCR”) of 8% at all times.

The minimum capital funds refers to paid-up capital and reserves as defined in Section 3 of Development Financial Institution

Act 2002.

In order to further strengthen the capital position of the Group and the Bank through a progressive and systematic building up

of the reserve fund, the Group and the Bank are required to maintain a reserve fund and transfer a certain percentage of its net

profits to the reserve fund once the RWCR falls below the threshold of 16%.

As at the reporting date, the reserve fund is not yet required as at the reporting date as the Group’s and the Bank’s capital is

currently above the threshold of 16%.

The Bank has adopted BNM’s transitional arrangements to add back a portion of the Stage 1 and Stage 2 allowance for ECL to

Tier 1 Capital over a four-year period from financial year beginning 2020. The transitional arrangements are consistent with the

guidance issued by the Basel Committee of Banking Supervision on “Regulatory treatment of accounting provisions – interim

approach and transitional arrangement” (March 2017) and “Measures to reflect the impact of Covid-19” dated April 2020.

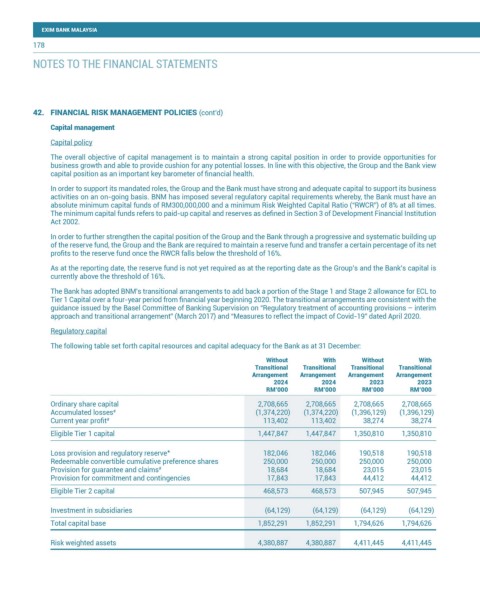

Regulatory capital

The following table set forth capital resources and capital adequacy for the Bank as at 31 December:

Without With Without With

Transitional Transitional Transitional Transitional

Arrangement Arrangement Arrangement Arrangement

2024 2024 2023 2023

RM’000 RM’000 RM’000 RM’000

Ordinary share capital 2,708,665 2,708,665 2,708,665 2,708,665

Accumulated losses (1,374,220) (1,374,220) (1,396,129) (1,396,129)

#

Current year profit 113,402 113,402 38,274 38,274

#

Eligible Tier 1 capital 1,447,847 1,447,847 1,350,810 1,350,810

*

Loss provision and regulatory reserve 182,046 182,046 190,518 190,518

Redeemable convertible cumulative preference shares 250,000 250,000 250,000 250,000

Provision for guarantee and claims 18,684 18,684 23,015 23,015

#

Provision for commitment and contingencies 17,843 17,843 44,412 44,412

Eligible Tier 2 capital 468,573 468,573 507,945 507,945

Investment in subsidiaries (64,129) (64,129) (64,129) (64,129)

Total capital base 1,852,291 1,852,291 1,794,626 1,794,626

Risk weighted assets 4,380,887 4,380,887 4,411,445 4,411,445